57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

The 7 Unusual Fundraising Lessons I Learned While Raising $1 Million +

[Warning: This post is geared for high-integrity people; if you’re dishonest, please don’t bother reading on or raising money from anyone.]

I’ve raised money twice: $1 million for ExpressDoctors (a flop) and $350,000 for Mojam (which got sold and is still around!).

I’m by no means a pro — you’ll find many others with more experience — but I don’t see too many of them writing about their experience.

I enjoy sharing my learnings with others in hopes of creating more awesome businesses, non-profits or other organizations in our Universe!

I’m leaving out the “Fundraising 101” type tips such as: Define the uses of the money you need; investing takes longer than you think; have a good business plan, have a name-brand/or trustworthy bank and law firm to process paperwork, etc. — you can find those tips anywhere.

My tips are, hopefully, a bit outside the box.

7 Tips On How To Raise Money

1) Create An Investor Pipeline

Crafting an investor pipeline is an easy and effective way to help raise money.

The reason you need to create a pipeline is that fundraising is simply a numbers game — you’re going to approach X # of people who will pay you $Y amount of money and some will turn you down and some will actually invest (if you work hard!).

Note: Check on How To Create A Sales Pipeline if you want to dig deeper into pipelines.

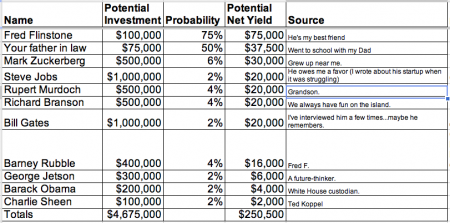

The key with the pipeline is to make your best guess as to how much they might invest and what the probability is that you could close them on that investment — you multiply those together and you get your “Potential Net Yield.”

Why?

The Potential Net Yield will help you rank which investor to focus on (even though Fred Flintstone (in the pipeline above) doesn’t have as much money to invest ($100K) as Steve Jobs ($1 Million), Fred might be someone to focus on first because he’s your best friend and the probability is so high that you’ll get him to invest, that’s a better use of your time.

The Potential Net Yield is also important in determining how many investors you should approach.

In the pipeline example above, if you approached all 12 of the investor prospects, you’d have a crack at raising $250,500 (the total Potential Net Yield).

If you need to raise $1 million, you better add a lot more prospects (or increase your probability for each of your current prospects).

2) It Takes The Same Amount Of Time To Get A $100,000 Check As It Does A $1,000 Check

This old cliche from business: “It takes as long to do a small deal as it does a big deal,” is mostly true.

I don’t mean that it’s just as easy to get your father-in-law to give you $100,000 as it is for him to hand you $1,000 — what I mean is that if you have two investors and their profile is this:

- Fred Flintstone with a net worth of $500,000; and

- Your Grandfather with a net worth of $5 million (10X the net worth of Fred Flintstone!)

…then — all other things equal — getting a check from Fred for $10,000 is going to be just as hard as getting a check from your grandfather for $100,000 (hint: focus more on your grandpa!).

Case in point: A friend of mine — who prides himself on being democratic/socialist — wanted to raise $250,000 from “friends and family” and he was dead-set on trying to get 10 of them to each invest exactly $25,000 apiece and in return they’d each get 1% of the company.

I warned him against this — “There is no reason you have to treat each of your investors exactly the same!”

One of his friends might be able to afford $100,000 and another friend might only be able to afford $10,000 — so treat them each with the uniqueness they deserve.

He convinced a couple of people to put in $25K but failed to raise the money he needed.

3) “Social Proof” — The First Investor Is Key

Raising money at every stage is hard — but the first check you get from someone is way harder than all subsequent checks.

This is Psychology 101 — many call it “Social Proof.” Few people want to be the first — but many folks don’t mind being second or third.

Use this to your advantage — try to focus your first talks with people who have a high probability of backing you.

It will also boost your confidence immensely.

I had the good fortune of having the CEO of my ex-employer (Michael Leeds) offer to be the first investor in my Mojam startup (for which I am eternally grateful). The second and third investors were much easier — I’d even go so far as to suggest that the 2nd and 3rd investors were 10X easier than the first investor.

4) Leverage As Many “Unfair Advantages” As You Have

Investors are like anyone else — they are motivated by their self-interests. The easiest example is money (though many will be motivated by changing the world/giving back, etc.).

Regardless of which motivation they have, they will want to hear what your unfair advantages are.

Examples of unfair advantages are:

- Unique access to an audience

- Clients lined up who have agreed to pay you

- Exclusive content

- Technology that’s beyond anyone else

- A key co-founder with lots of experience

- etc.

5) Focus On The Person, Not The Firm

If you’re raising money from a firm (e.g. venture capital, private equity), don’t lose sight of the fact that there is one human being there who needs to champion you.

Your “selling” of this individual is your way of getting the entire firm on-board.

Start with the individual, not the entire firm.

6) Who Is In “The Syndicate”?

The leading angel investors in Silicon Valley are parts of “syndicates” — they invest with others they know.

“Super-Angel” investor Ron Conway is said to prefer to invest only once certain other investors (his “syndicate”) have committed.

So, if you happen to hear that about one of your investor prospects, you obviously want to focus on the other members of the Syndicate.

7) Investor Relationships Are Best Measured In Years (Not Weeks Or Months)

The longer you have known your potential investor, the easier it will be to raise money from them (assuming you’ve shown yourself to be high integrity).

Knuckle-head Check-In — If you low–integrity knuckle-heads are still reading this article, please go attend Honesty School before applying any of these tips!

So, if you’re even thinking about raising money, start focusing on building trusting relationships with your prospects…that’s easier to do now than it is when you’re asking them for a check.

I wouldn’t invest in anyone I haven’t known for a couple of years…unless they were endorsed by my “syndicate.”

Tweet 4 Comments