57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

A Rule of Human Systems: Leadership Will Always “Pass the Baton”

Tweet CommentCharlie Munger frequently emphasizes that anyone in a position of dominance will inevitably “pass the baton” of leadership.

Below are some examples Charlie has mentioned in talks:

Transcript from the 2003 Wesco Annual Meeting, May 7, 2003 *

“The loss of dominance rate is 100%. Every great civilization that was dominant eventually passed the baton. Similarly, the greatest companies of yore are not the great companies of hence. I like looking back and seeing who would have predicted what happened to [formerly great companies like] Kodak, Sears and General Motors.”

Transcript from Wesco Annual Meeting, May 6, 2009*

“Where is Egypt or Athens or London? It is nature of things that we do baton passing. It is state of nature that baton gets passed, to someone who tries harder and cares more.” …

No comments yet | Continue Reading »

Sunday, March 30th, 2014

The Law of Scale (the benefits are “Ungodly Important”)

Tweet CommentIn his epic commencement speech to the USC law school grads in 1994, Charlie Munger mentions “scale” 24 times.

The advantages of scale are “ungodly important”, he points out.

Benefits of Scale = Lower Costs, Higher Prices & Bets on New Markets

Benefits of scale include reducing costs, raising prices and testing new markets.

In a beer business, for example, Anheuser-Busch operates at such a higher volume than Anchor Steam beer (based in San Francisco), that …

No comments yet | Continue Reading »

Sunday, March 9th, 2014

The Mental Model of Incentives

Tweet CommentCharlie Munger wrote in Poor Charlie’s Almanack:

“Perhaps the most important rule in management is to get the incentives right.” (see 30+ Charlie Munger Quotes).

Charlie argues that people respond most strongly to what they view as their incentive or disincentive.

In business, there is almost always someone else involved in whatever you are trying to do. Munger recommends that you always reflect on:

“What is someone getting out of this.”

Charlie gives a few business examples of incentive bias (source: Poor Charlie’s Almanack).

FedEx …

No comments yet | Continue Reading »

Sunday, February 23rd, 2014

The Mental Model of Confirmation Bias (aka Goal Seeking or My Side Bias )

Tweet 1 CommentConfirmation Bias is the tendency of people to favor information that confirms their own beliefs, goals or desired outcomes (and ignore what doesn’t fit).

A definition of confirmation bias from the book Consumer Behavior:

“The tendency of consumers to interpret ambigious evidence as consistent with their current beliefs.”

A business example of confirmation bias is the hugely popular personality-type quizzes (e.g. which ‘Beatle member are you?’ or ‘What type of Ice Cream are you?’). When people take those quizzes they are typically reaffirming the opinion they already have in their mind (“I’m Mick Jagger of course”).

A trick of those quizzes is that most of the successful ones return you results that are positive (you’re unlikely to find one that asks ‘Which mass murderer are you?).

Why do people do this? According to PsyBlog:

“In an uncertain world, people love to be right because it helps us make sense of things. Indeed some psychologists think it’s akin to a basic drive.”

1 comment so far | Continue Reading »

Tuesday, July 9th, 2013

The Mental Model of Compound Interest

Tweet CommentThis article on Compound Interest continues my quest to list out the Top 100 Mental Models Needed to Succeed in Business, inspired by Charlie Munger.

Munger calls compound interest “one of the most important models there is on Earth.”

It arises when interest is added to the principal.

If you don’t know how to use compound interest on a calculator, there are a couple of excellent online compound interest tables/calculators that do all the work for you here:

For example, …

No comments yet | Continue Reading »

Saturday, July 6th, 2013

The Mental Model of “Inversion” in Business

Tweet 1 CommentYou know the story of the man who wanted to know where he was going to die, so he could make sure not to go there?

That’s a favorite story of Charlie Munger’s to explain the concept of inversion.

Munger credits mathematician Carl Jacobi (who famously said: “Invert, always invert”) who recommended working through math problems in reverse.

As A Margin of Safety wrote in Invert, Always Invert, an example of inversion (working through a problem backwards) came from University of Florida professor Jay Ritter who looked at the problem of whether to invest in Facebook around the time of its IPO. …

1 comment so far | Continue Reading »

Sunday, March 17th, 2013

The Mental Model of AutoCatalysis (aka “Evergreen” or “Self-Breeding”) in Business

Tweet CommentI first heard of AutoCatalysis being used as a business tool from reading Charlie Munger.

AutoCatalysis originates in chemistry, a subject I did poorly in in high school, so I’ll give this definition from The Focus Investing Series Part 3: The Munger Network of Mental Models:

“In the autocatalysis process, properties, events or products serve as their own catalysts and are “self-breeding. For example the self-stimulated increase in the demand for air conditioning, hence the self-stimulated increase in the demand for air conditioners.”

No comments yet | Continue Reading »

Tuesday, December 25th, 2012

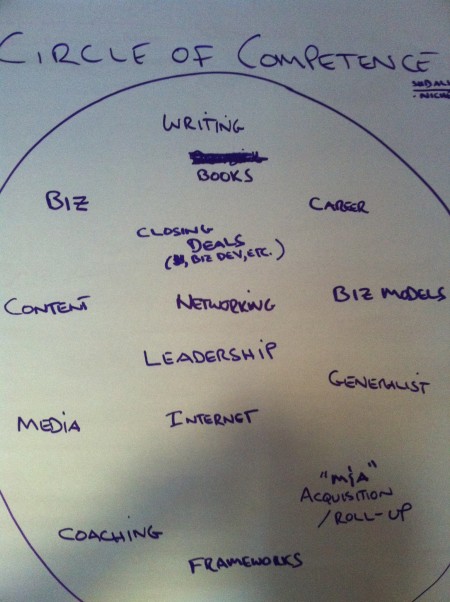

How I Created My Own Circle Of Competence

Tweet 4 CommentsThe Circle of Competence was one of the most important exercises I did before founding our current company Ongig.

The Circle of Competence is simple: you write down the things that you are competent about and draw a circle around it. And then, as Buffett explains, remember that the more you go outside your circle of competence, …