57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

Wanna Buy Facebook Stock Pre-IPO? — Tips Inside

Tweet 5 CommentsI sat in on a conference call hosted by Sharespost, a marketplace for privately-held stock, today to learn more about buying stock in private companies. Nearly 100 Sharespost members were on the phone.

Facebook Founder Mark Zuckerberg at South By Southwest 2008

I thought I’d share the basics of how buying privately-held stock works using Facebook (the topic of today’s call) as the example.

The below information is based on knowledge as well as things I learned from today’s call (hosted by Tim Sullivan of Sharespost).

How do you buy Facebook stock when it’s still privately-held?

Some Facebook insiders, such as former employees, have begun to sell their privately-held shares through new private exchanges such as Sharespost, SecondMarket, Cogent Partners and Campbell Luytens.

Who is selling the Facebook stock in this case?

A former Facebook employee is selling 50,000 shares of their Facebook stock, according to Tim Sullivan of Sharespost.

Do you buy Facebook stock directly from the employee?

No. You typically buy membership units in a new fund that buys the Facebook stock for a group of investors and you own your pro-rata % of the fund.

For example, Sharespost in this case is offering membership units in a newly-formed Delaware-based LLC that will hold up to 50,000 of Facebook’s privately-held shares at $20 per share.

Can anyone buy these Membership Units?

No. You have to be an accredited investor and you have to be chosen by the firm (e.g. Sharespost in this case) offering the Membership Units.

There may also be a minimum investment you have to make to be buy Membership Units (e.g. Sharespost is asking that you commit at least $100,000).

Who sets the price of the privately-held Facebook stock?

In this case, Sharespost is setting the price. They have closed an exclusive deal with the former Facebook employee to buy their 50,000 shares at $20 each (a total of $1 million).

What is Facebook’s valuation?

Around $45 billion based on these Sharespost Membership Units.

Can Facebook veto the purchasing of their stock by outsiders.

Yes. Facebook can exercise their right of first refusal (also known as a “rofer” or “rofering”) on stock that their insiders are trying to sell within 30 days of the attempted sale of the Facebook stock.

How often does Facebook “rofer” their stock?

Facebook rofers their purchase of privately held Facebook stock about half the time it’s available, according to Sharespost’s Tim Sullivan. He added that he heard that Facebook rofered stock at $18 per share recently.

When could a buyer of these Facebook Membership units sell their stock?

Owners of the Facebook Membership Units could sell their stocks through Sharespost private marketplace (though it’s not guaranteed that there will be a buyer) or at the point of a Facebook IPO (Initial Public Offering).

note: there will be lock-up restrictions on the exact timing of your sale of the Membership Units/Facebook stock.

What commission does the private marketplace (e.g. Sharespost) take in the transaction.

Sharespost is charging a one0time services fee of 5% and a distribution fee of 3% (of the total size of the round of funds they raise through the private placement).

Is SharesPost affiliated with Facebook.

No.

Does Facebook have audited financials that the public (or prospective buyers of the Membership Units) can see?

No.

What’s Facebook’s estimated revenues or profits.

It’s not publicly disclosed, but there are reports of Facebook’s revenues for 2010 being projected at anywhere from $1.5 billion to $2.4 billion, according to Tim Sullivan.

Is Facebook profitable?

Tim says that there are reports of Facebook being more profitable (on a margin basis) than Google, one of the most profitable publicly-traded Internet companies.

Has Facebook’s stock recently split?

Yes, there was a 5 for 1 split of Facebook shares October 1, 2010, according to Tim Sullivan.

Will Sharespost offer additional Facebook shares for purchase in the future.

Yes. Sharespost expects to offer additional Facebook shares in the future. Other private marketplaces likely will too.

5 comments so far (is that a lot?) | Continue Reading »

Friday, November 19th, 2010

How To Build A Successful Business From The Ground Up (Tips From Gerber!)

Tweet 5 CommentsIf you love business and are, or are considering, starting a business, the book E-Myth by Michael Gerber (sketched below) is a must-read.

Gerber is a master of teaching business who has taught thousands of business leaders.

Here are some key takeaways from The E-Myth Revisited:

The Three Personalities Of Every Business-Person

1) The Entrepreneur

- The visionary

- The dreamer

- The catalyst for change

- Turns a trivial condition into an exceptional opportunity

Blind Spot: Most people are problems that get in the way of the entrepreneur.

2) The Manager

- The planner

- Thinks in the past

- The catalyst for status-quo

- Looks at opportunities as potential problems

The Manager chases after the Entrepreneur to clean up their mess…for without the Entrepreneur, there would be no mess!

3) The Technician

- The doer

- The tinkerer

- Lives in the present

- If the Technician doesn’t do it, it won’t get done

The Three Stages of Business

1) Infancy Stage

In Infancy, you (the founder) ARE the business. You’re often working 10+ hours a day and absolutely nailing your business. You’re likely mostly being the Technician described above.

How do you know if you’re in Infancy?

Answer: If you were removed from the business, the business would disappear.

So, you don’t want to be an Infant very long.

Infancy ends when you decide that your business can not continue to be run where it’s nearly 100% dependent on you (many owners quit in their Infancy stage).

2) Adolescence

If you don’t quit your biz at this point, you move on to the Adolescence stage.

Adolescence begins when you decide to get some help.

This is often precipitated by a crisis in the Infancy stage. 😉

Gerber cautions that a major mistake many entrepreneurs make during Adolescence is that when they make their first hire they Manage by Abdication (handing off an assignment and running away) rather than Manage by Delegation.

And Gerber points out that when you Manage by Abdication, the person/people you hired will begin dropping some balls…you may start to notice that:

- the product might not be quite the same quality as when you built it

- the marketing might not convert quite as well

- customer service might become a little loosey-goosey

The reason: because you didn’t teach your new hire well enough!

You weren’t being a good “Manager.”

And then the Technician in you jumps back into action…micro-managing every part of the business process to fix the product, the marketing, the customer service.

Before you know it, you are back doing all the work again…being the “Technician.”

At this point, a business usually faces 3 scenarios…they:

- Get Small Again — They go back to the Infancy stage; the owner may get rid of their new hire(s)) and revert back to a sole-proprietorship.

- Go For Broke — They just keep going and try to scale up…these usually end up in a melt-down.

- Remain An Adolescent — They stay put as a grumpy owner of a small poorly-managed business, usually to the detriment of their friends, family and, especially, their business.

But there is hope, Gerber points out, and that’s the highest level of a business performance.

3) Maturity

So how do you become a “Mature” business? Simple…you start out that way!

Gerber points out that IBM’s Tom Watson attributed the following to IBM’s success:

“I had a clear picture of what the company would look like when it was finally done”

“I then asked myself how a company which looked like that would have to act.”

“…we began to act that way from the beginning.”

“In other words, I realized that for IBM to become a great company it would have to act like a great company long before it ever became one.”

These moves by an “Entrepreneur” at the beginning of a business are thus quite key.

How To Create A “Mature” Business From The Ground Up

Gerber then recommends a series of tips/approaches to how an Entrepreneur can design a business from the ground up as one that will become mature and successful. They include:

- Turn-Key Systems — Provide the rest of the business with the system to execute. This will likely require documentation of the business’ systems in Operations Manuals that serve as a checklist for each component of your business.

- Work On Your Business, Not In It — “Your business is not your life,” Gerber emphasizes. It is an “organism…that will live or die according to how well it performs its sole function: to find and keep customers.”

- Your Primary Aim — You the business owner need to articulate (for yourself) your “primary aim” (as Gerber calls it). I call this a Life Purpose and you can try my How to Write A Purpose Statement article which includes an exercise that you could use to figure out your “Primary Aim” in life.

- Strategic Objective — Develop a clear statement of what your business has to do to help you achieve your Primary Aim.

- What’s Your Product — “What feeling will your customer walk away with? Peace of mind? Order? Power? Love? What is he really buying when he buys from you?”

5 comments so far (is that a lot?) | Continue Reading »

Thursday, November 18th, 2010

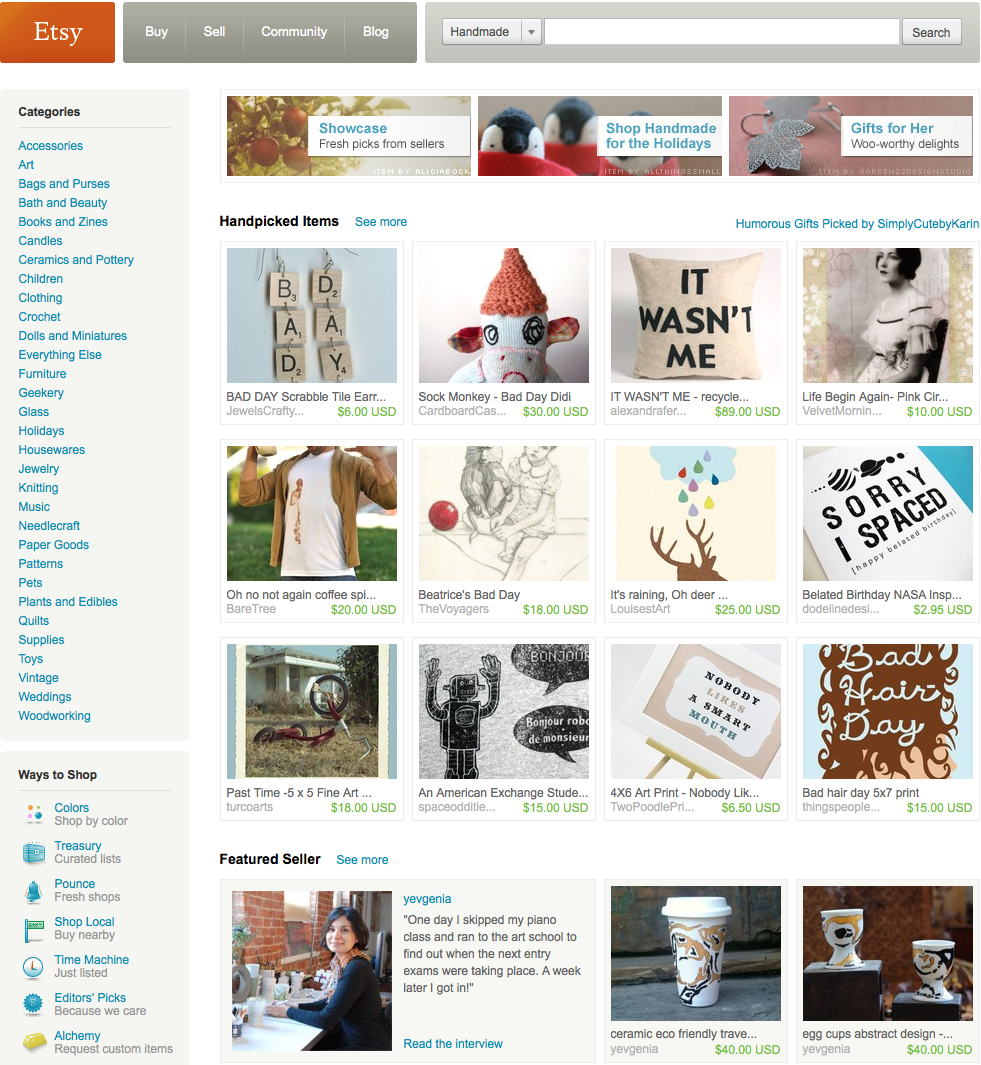

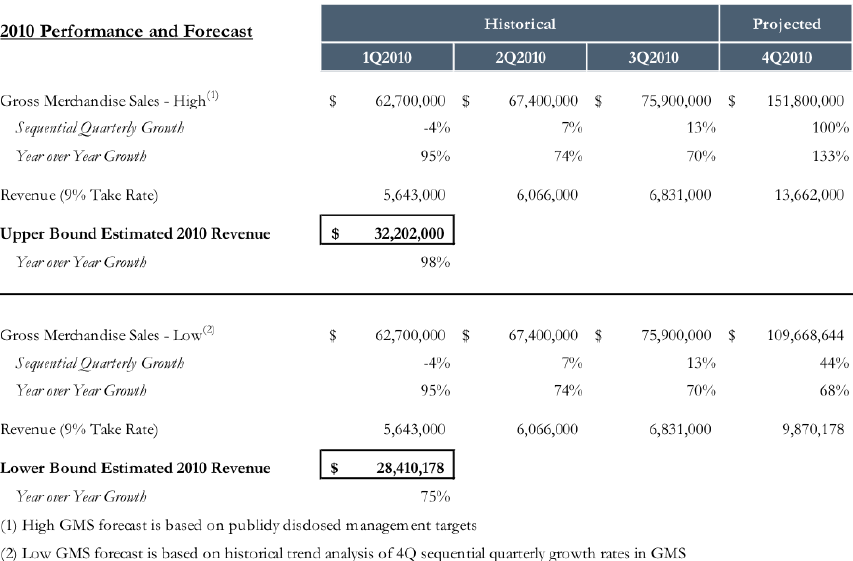

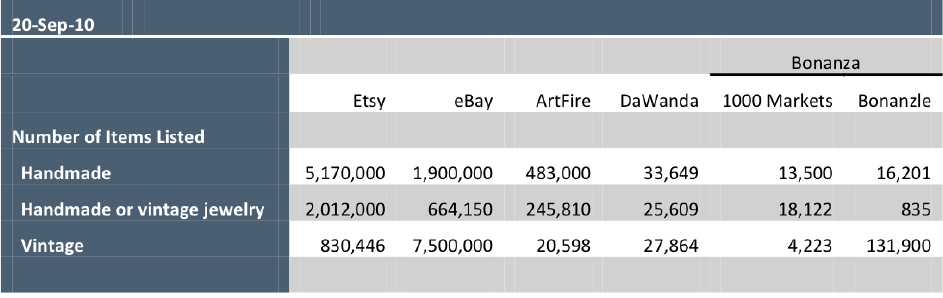

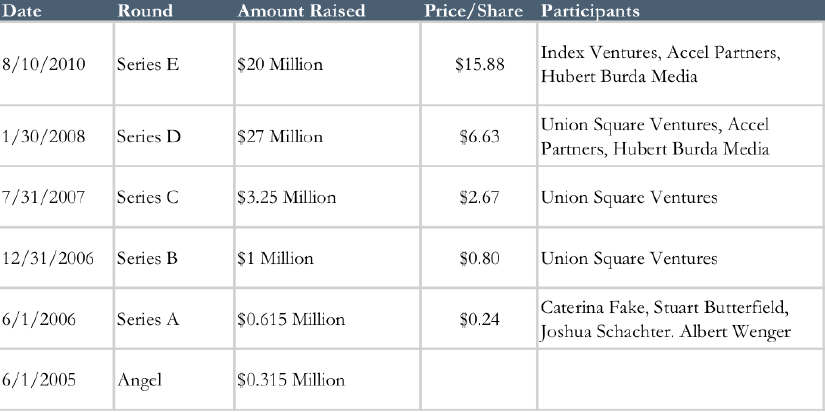

Etsy: The “eBay of Handmade Goods” Worth $258 Million?

Tweet 1 CommentI was on an interesting conference call by Arcstone Equity Research & SharesPost in which they walked through the Web business Etsy.

New York-based Etsy is clearly a company on the move.

What Is Etsy?

The gist of Etsy’s business is that they’re a marketplace of hand-made goods (sort of eBay but primarily hand-made)…here’s a screen shot showing you some of the types of things they sell.

Disclaimers: The #s I mention are not from Etsy (they are all estimates based on Arcstone Equity Research & SharesPost)

Special thanks to Arcstone & SharesPost for all the graphs below:

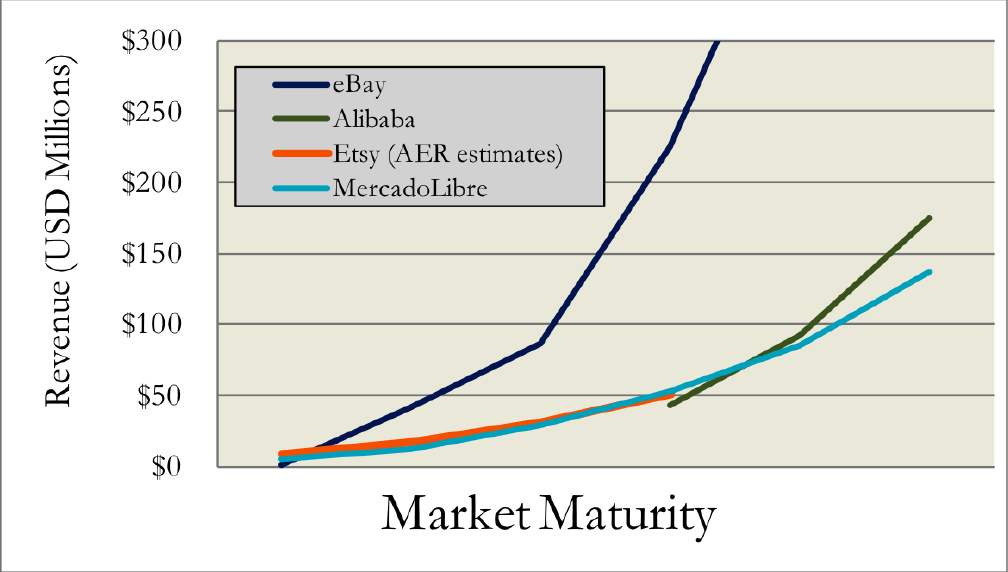

Etsy’s Growing As Fast As Alibaba (But Not As Fast As eBay)

Etsy Business Model

- Taking 3.5% of every sale and $.20 per item for a listing fee

- Selling advertising (where they make about half their money)

![Etsty's Gross Merchandise Sales By Month 2008 to 2010 from Arcstone]](https://robdkelly.com/wp-content/uploads/2010/11/Screen-shot-2010-11-18-at-10.19.13-AM1-1024x495.png)

Etsy Revenues, Profits, etc.

- Estimated Valuation: $258 Million

- Estimated Revenue

- $16M in 2009 ($180 million in gross transaction values)

- $30M in 2010 (on $335 million in gross transaction values)

- Around $54M is projected in 2011

- Profitable

- 120 employees

Etsy’s Team

Top Officers

- Robert Kalin

- Chad Dickson (Yahoo)

- Alan Freed (Google)

Outside Board Members

- Jim Breyer

- Fred Wilson

- Caterina Fake

Etsy Competition

Some sites like Etsy are:

- eBay (both through its own service and through acquisition of World of Good)

- ArtFire

- DaWanda (in England, France & Germany)

- 1000 Markets

- Bonanzle

Etsy Financing To Date

Other Etsy Highlights

- 4.4 Million members

- Hired a new COO (Alan Freed) from Google last year who has an emphasis on International

- 2 million of 5 million products are Jewelry

Etsy’s Valuation

- $258 Million (10X Annual Revenues (discounted 15% for lack of marketability))

My Take On Etsy

Fascinating Internet business on the move…a real niche dominator.

My best guess as to what will happen with Etsy: They will go public or be acquired by Amazon (Amazon loves to take out companies when they’re in the $100 million to $500 million per year revenue and if they own a niche).

1 comment so far | Continue Reading »

Thursday, November 11th, 2010

Why Did Ballmer & Others Dump A Record $4.5 Billion In Stock Last Week?

Tweet CommentWhen a super smart guy like Steve Ballmer (he is that smart…I’ve met him a few times) dumps $1.34 billion worth of stock — his first stock sale in 7 years! — I like to dig in a bit

Ballmer was part of a slew of insider stock sales last week, which saw a 2-year high in stock prices.

The volume of insiders selling their stock versus those buying their stock is a good leading indicator of where the stock market might head.

Afterall, if insiders (defined as stock sales by directors, executives or employees of a public company) are selling their own stock, it may be because they believe the stock price has hit a peak (alternatively, they may just need some quick cash).

In more extreme examples, insiders may sell their stock because the company is in real trouble; some speculate that’s what was happening in the below chart (from a decade ago) showing an Enron insider selling a bunch of stock (the blue columns) when the stock price was peaking (the red line).

The news this week doesn’t necessarily involve fraudulent activity but clearly some insiders see the market peaking.

Back to Ballmer…

Ballmer was among executives at 125 companies in the S&P 500 who sold a total of $4.5 billion in stock between Nov. 3rd and 9th… at a ratio of 12 insider sellers for ever 1 insider buyer.

That’s the highest ratio of sellers to buyers on record (InsiderScore has only been tracking the data since January 2004).

The best other explanation for high insider sales is that some insiders may be worried that their capital-gains tax rate for assets owned at least a year will increase from 15 percent 20 percent in January (unless President Barack Obama and Congress extend the 15% rate.).

My take is that the reason for the record insider sales is a combination of insiders thinking that the market may be peaking AND some folks worried that cap gains taxes are going up.

No comments yet | Continue Reading »

Thursday, November 4th, 2010

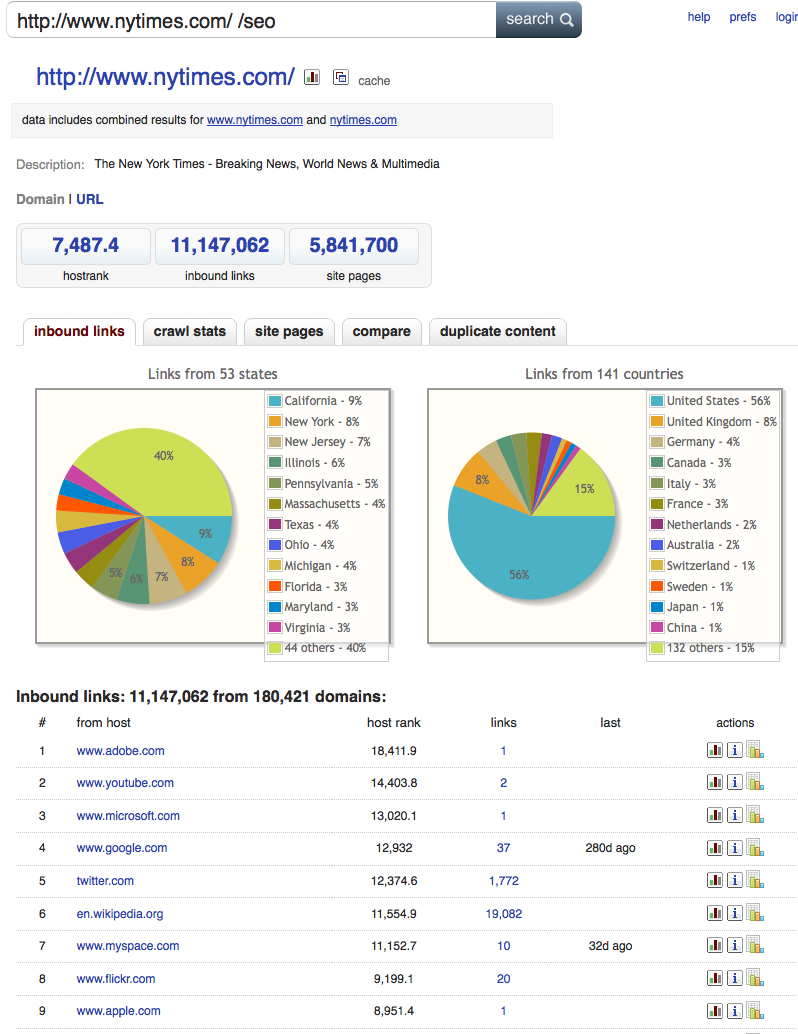

Blekko Is Good For Seeing SEO Stats On Any Web Sites

Tweet 2 CommentsI’ve been playing around with the new Blekko search engine. They seem to do a reasonable job with speedy and comprehensive search results.

But what’s really cool is their SEO (Search Engine Optimization) tools.

You can download the Blekko toolbar (free). here it is:

…to easily do this or, if you don’t feel like another toolbar, then you can type in the below string into your Web broswer URL field (just replace “nytimes” with any Web site URL if you want to see another Web site’s SEO results):

http://blekko.com/ws/www.nytimes.com+/seo

…or you can just click the image below and then play around from there.

The results above include such things as:

- # of inbound links

- # of Web site pages

- breakdown of links by city and country

- a list of links by the highest ranked Web sites (e.g. Adobe, YouTube and Microsoft.com are the Web that link to NYTimes.com (according to Blekko)

Thanks to Chris Tew for pointing this out to me!

2 comments so far (is that a lot?) | Continue Reading »

Wednesday, November 3rd, 2010

A Simple Way To Increase Your Confidence (Fun Too!)

Tweet 3 CommentsMost of us can use a confidence boost once in awhile. Here’s one exercise I used that works…and it actually feels good and positive as you’re doing it!

I call it the…

“Qualities of Achievement Exercise”

Step 1: Write Down One Achievement In Your Life You’re Really Proud Of

Write down something that you’ve done that you’re really proud of in life — it can be related to business, family, sports or anything.

What’s important about the achievement you select is that it made you feel really good.

Here are examples of achievements I’m proud of:

- Winning the championship at a basketball tournament in Fire Island (pictured above)

- Moving to San Francisco from New York (which I decided spontaneously with my then-girlfriend in a NY cafe)

- Founding a start-up

- Playing guitar onstage with my buddy Larry at his wedding reception (see picture below)

Step 2: Write Down The Qualities You Possessed For The Achievement

To the right of the achievement, write down the qualities you possessed (or conditions you set up) to make that achievement happen.

For example, to win the basketball championship I wrote down things like:

- I practiced 3 times a week (aka ‘created a ritual’)

- I focused on my strengths (aka ‘unique abilities’)

- I was a team player

- I gave it everything I had

- I was in good physical shape

It helps to write these down as “I [fill in the blank]” statements.

You should have at least 5 to 10 of these qualities.

Ok, you should be feeling pretty good about yourself at this point…after all, you’re revisiting some amazing achievement from your life! That was a great day, wasn’t it!?

So, let’s do another achievement (you’ll later see that it’s important to do multiple achievements).

Step 3: Write Down A Second Achievement & List Out The Qualities/Conditions

Step 4: Write Down A Third Achievement & Do The Same

Step 5: Create Your Master List of Qualities Of Achievement

Now that you’ve done 3 achievements, you should have a list of a couple of dozen qualities listed.

Review the list on the right-hand side (the reasons you accomplished these achievements) as this is your master list of “Qualities of Achievement” — some of the many things you possess to do amazing things.

There will be qualities that repeat among achievements too — even though you may use slightly different language for them — those repeat qualities are arguably among the most powerful qualities you possess!

I found it useful to make a separate list (mine is below) of the repeating qualities. Here are some of my own:

| I utilized my network of contacts |

| I was bold |

| I focused |

| I bought time |

| I was positive |

| I leveraged my unique abilities |

| I created a plan |

| I did the “right thing” |

| I was persistent |

| I practiced |

| I created rituals |

| I was persuasive |

Step 6: Whip Out Your Qualities Of Achievement Any Time You Need A Confidence Boost

Now, what’s cool is that any time you are facing some new endeavor, you can look at your ‘Qualities of Achievement List” to be reminded of the qualities YOU possess to further achieve!

Furthermore, these qualities will give you ideas on how to tackle your new achievement!

After all, you achieved greatness before…and you will surely achieve it again!