57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

Are These 7 Items Pointing To A Coming Economic Armageddon?

Tweet 3 CommentsI’m an optimist by nature but — hopefully you see that through the rest of my articles here — but I’m also practical.

And there’s a weird amount of $hit going on in the U.S. and abroad these days that’s got me preparing for a possible economic meltdown.

And I’m not talking about the staggering U.S. federal deficit — that’s got serious longer-term consequences. I’m talking about a handful of other scary items that worry me more in the short-term. …

3 comments so far (is that a lot?) | Continue Reading »

Tuesday, February 22nd, 2011

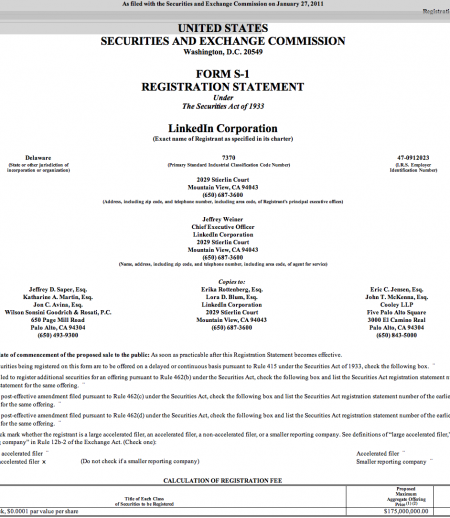

LinkedIn IPO: Highlights From Their S-1 Filing

Tweet 2 CommentsI’m one of those weird guys who likes to pour through documents like the 182-page LinkedIn S-1 Registration Statement (while flying to Salt Lake City for a trip with high-school buddies!).

An S-1 is what a company files in preparation for “going public.”

Here are some highlights:

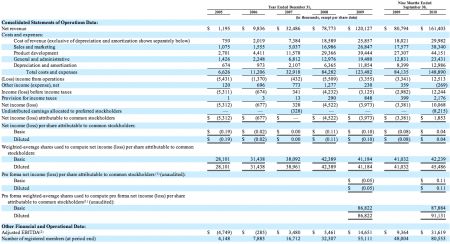

Estimated LinkedIn Revenue & Profits in Calendar 2010

- Revenue: $215 million

- Net Income: $13.4 million*

This excludes what looks like an $8.2 million payout to preferred shareholders

LinkedIn Revenue Growth*

- 2009 to 2010: 99.7% (impressive that they doubled in the last year)

- 2008 to 2009: 53%

- 2007 to 2008: 142%

* 2009 to 2010 reflects just 9 month periods.

LinkedIn Revenue Breakdown By Product Line*

Hiring Solutions: 44% — Recruiters (3,900 of them in 2010) pay LinkedIn to access and market to its database of users. This includes 69% of the Fortune 100.

Advertising: 31% — Marketers (33,000 in 2010) run ads on LinkedIn’s page views.

Subscriptions: 25% — LinkedIn members can use much of LinkedIn for free but there are additional things that users must pay for (such as seeing more than 100 results at a time or being able to filter your searches by seniority of a LinkedIn member).

*Breakdown as of quarter ended Sept. 30, 2010

“LinkedIn is not as automated a business as some may think…over half their revenue comes from Field Sales.”

LinkedIn Revenue By Sales Channel

- Field Sales: 54%

- Online Sales: 46%

Due in part to LinkedIn’s money spent on a sales team in the field, their profit margins are lower than Google’s and Facebook’s.

“I bet that Groupon’s profit margins will be closer to LinkedIn’s than they are to Google or Facbeook when Groupon files its S-1…due to the large field sales team they employ. “

Did anyone notice that I just quoted myself? I’m just trying to break up the text components here!

LinkedIn’s Profit Margins*

- Gross Margin: 81.4%

- Adjusted EBIDTA: 19.6%

- Operating Margin: 7.8%

- Profit Margin: 6.2% (this compares to 28%+ for Google and a rumored 25.7% for Facebook)

* For the 9 months ended Sept. 30, 2010

Interesting Stats On The LinkedIn Database*

- 90 Million+ members

- 1 million+ companies listed

- 2 million+ groups

- 25,000 jobs were posted per week (on average) during 2010

*As of December 31, 2010

LinkedIn Traffic Per Quarter (end of 2010)

- 65 million unique visitors

- 5.5 billion page views

LinkedIn’s International Business

- 27% of net revenues come from outside the U.S.

LinkedIn Valuation

LinkedIn is currently being valued at around $2.9 billion according to the latest shares being sold on SharesPost (note: this is not in the S-1 Registration).

A LinkedIn IPO could value the company at a great price than the $2.9 billion based on those recent privately-traded LinkedIn shares.

Of course, the LinkedIn valuation could change big time if we have an Internet bubble burst before they go public.

2 comments so far (is that a lot?) | Continue Reading »

Wednesday, December 22nd, 2010

Warren Buffett Video Teaching You How To Be A Business Hero

Tweet CommentI found this terrific video (below) in which Buffett teaches students how to become the business hero they want to be (the video is pretty crappy quality but fantastic content!).

I wrote down the basics of the exercise (it starts around Minute 2 of the above video)

As Buffett explains, you don’t have to be a student to benefit from this exercise, but the earlier in life you do it the better!

Ok, grab a piece of paper…this won’t take long:

1) Pick a fellow student/colleague who you’d like to own 10% of for the rest of their lifetime

Question: Is it the person with the:

- Highest IQ (probably not)

- Highest grades (probably not)

Buffett thinks you’ll probably end up looking for qualitative factors such as:

- Honesty

- Leadership

- Generous

- Gave credit to

- Temperament

Write down the qualities of that person you want to own 10% of on the left-hand side of a piece of paper.

and then, to continue the exercise, you then:

2) Pick a person who you would like to “sell short” based on their performance for life.

This would probably not be the person with the lowest IQ or lowest grades — more likely, Buffett says, this person has turned you off with such qualities as:

- Egotism

- Dishonesty

- They cut corners

Write down the qualities of this person you want to “sell short’ on the right-hand side of your sheet of paper.

Buffett suggests that if you focus on emulating the qualities on the left-hand side and avoiding the qualities on the right-hand side, you’ll eventually become the person that you want to own 10% of.

But even better than owning 10% of that person, you’ll own 100% of that person…because it’s yourself!

No comments yet | Continue Reading »

Monday, November 22nd, 2010

Wanna Buy Facebook Stock Pre-IPO? — Tips Inside

Tweet 5 CommentsI sat in on a conference call hosted by Sharespost, a marketplace for privately-held stock, today to learn more about buying stock in private companies. Nearly 100 Sharespost members were on the phone.

Facebook Founder Mark Zuckerberg at South By Southwest 2008

I thought I’d share the basics of how buying privately-held stock works using Facebook (the topic of today’s call) as the example.

The below information is based on knowledge as well as things I learned from today’s call (hosted by Tim Sullivan of Sharespost).

How do you buy Facebook stock when it’s still privately-held?

Some Facebook insiders, such as former employees, have begun to sell their privately-held shares through new private exchanges such as Sharespost, SecondMarket, Cogent Partners and Campbell Luytens.

Who is selling the Facebook stock in this case?

A former Facebook employee is selling 50,000 shares of their Facebook stock, according to Tim Sullivan of Sharespost.

Do you buy Facebook stock directly from the employee?

No. You typically buy membership units in a new fund that buys the Facebook stock for a group of investors and you own your pro-rata % of the fund.

For example, Sharespost in this case is offering membership units in a newly-formed Delaware-based LLC that will hold up to 50,000 of Facebook’s privately-held shares at $20 per share.

Can anyone buy these Membership Units?

No. You have to be an accredited investor and you have to be chosen by the firm (e.g. Sharespost in this case) offering the Membership Units.

There may also be a minimum investment you have to make to be buy Membership Units (e.g. Sharespost is asking that you commit at least $100,000).

Who sets the price of the privately-held Facebook stock?

In this case, Sharespost is setting the price. They have closed an exclusive deal with the former Facebook employee to buy their 50,000 shares at $20 each (a total of $1 million).

What is Facebook’s valuation?

Around $45 billion based on these Sharespost Membership Units.

Can Facebook veto the purchasing of their stock by outsiders.

Yes. Facebook can exercise their right of first refusal (also known as a “rofer” or “rofering”) on stock that their insiders are trying to sell within 30 days of the attempted sale of the Facebook stock.

How often does Facebook “rofer” their stock?

Facebook rofers their purchase of privately held Facebook stock about half the time it’s available, according to Sharespost’s Tim Sullivan. He added that he heard that Facebook rofered stock at $18 per share recently.

When could a buyer of these Facebook Membership units sell their stock?

Owners of the Facebook Membership Units could sell their stocks through Sharespost private marketplace (though it’s not guaranteed that there will be a buyer) or at the point of a Facebook IPO (Initial Public Offering).

note: there will be lock-up restrictions on the exact timing of your sale of the Membership Units/Facebook stock.

What commission does the private marketplace (e.g. Sharespost) take in the transaction.

Sharespost is charging a one0time services fee of 5% and a distribution fee of 3% (of the total size of the round of funds they raise through the private placement).

Is SharesPost affiliated with Facebook.

No.

Does Facebook have audited financials that the public (or prospective buyers of the Membership Units) can see?

No.

What’s Facebook’s estimated revenues or profits.

It’s not publicly disclosed, but there are reports of Facebook’s revenues for 2010 being projected at anywhere from $1.5 billion to $2.4 billion, according to Tim Sullivan.

Is Facebook profitable?

Tim says that there are reports of Facebook being more profitable (on a margin basis) than Google, one of the most profitable publicly-traded Internet companies.

Has Facebook’s stock recently split?

Yes, there was a 5 for 1 split of Facebook shares October 1, 2010, according to Tim Sullivan.

Will Sharespost offer additional Facebook shares for purchase in the future.

Yes. Sharespost expects to offer additional Facebook shares in the future. Other private marketplaces likely will too.

5 comments so far (is that a lot?) | Continue Reading »

Thursday, November 18th, 2010

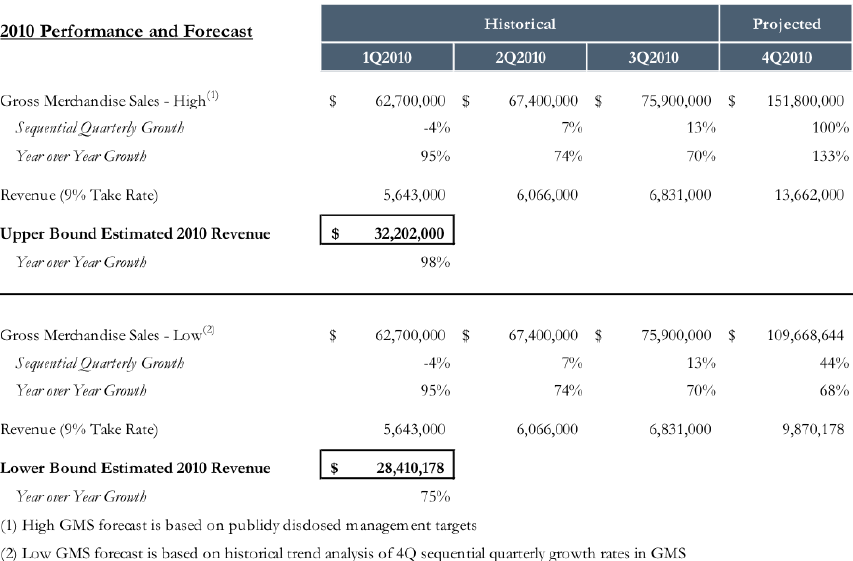

Etsy: The “eBay of Handmade Goods” Worth $258 Million?

Tweet 1 CommentI was on an interesting conference call by Arcstone Equity Research & SharesPost in which they walked through the Web business Etsy.

New York-based Etsy is clearly a company on the move.

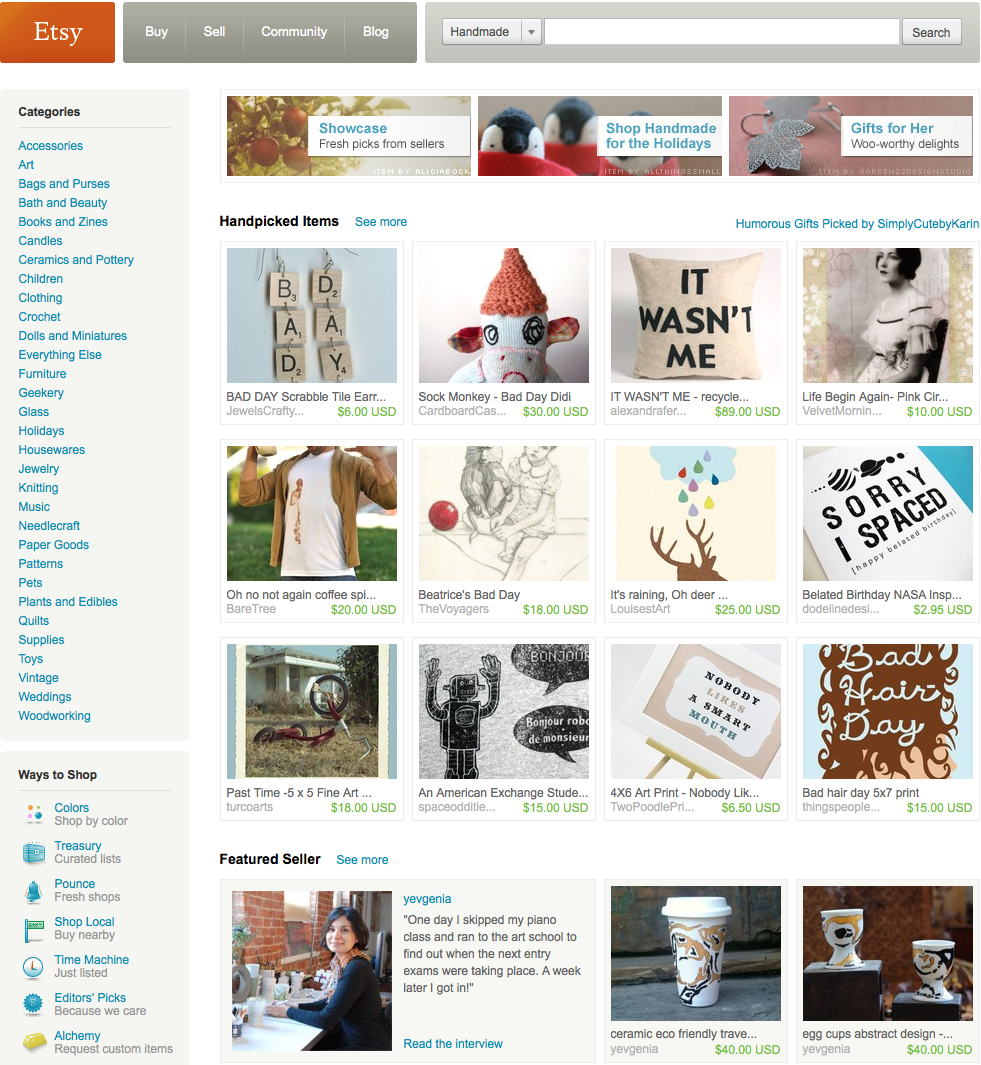

What Is Etsy?

The gist of Etsy’s business is that they’re a marketplace of hand-made goods (sort of eBay but primarily hand-made)…here’s a screen shot showing you some of the types of things they sell.

Disclaimers: The #s I mention are not from Etsy (they are all estimates based on Arcstone Equity Research & SharesPost)

Special thanks to Arcstone & SharesPost for all the graphs below:

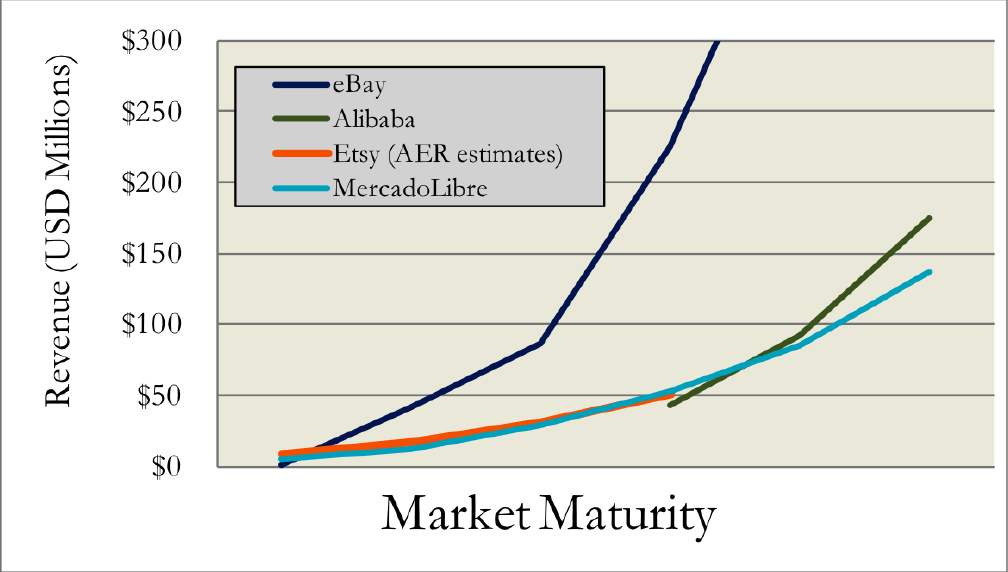

Etsy’s Growing As Fast As Alibaba (But Not As Fast As eBay)

Etsy Business Model

- Taking 3.5% of every sale and $.20 per item for a listing fee

- Selling advertising (where they make about half their money)

![Etsty's Gross Merchandise Sales By Month 2008 to 2010 from Arcstone]](https://robdkelly.com/wp-content/uploads/2010/11/Screen-shot-2010-11-18-at-10.19.13-AM1-1024x495.png)

Etsy Revenues, Profits, etc.

- Estimated Valuation: $258 Million

- Estimated Revenue

- $16M in 2009 ($180 million in gross transaction values)

- $30M in 2010 (on $335 million in gross transaction values)

- Around $54M is projected in 2011

- Profitable

- 120 employees

Etsy’s Team

Top Officers

- Robert Kalin

- Chad Dickson (Yahoo)

- Alan Freed (Google)

Outside Board Members

- Jim Breyer

- Fred Wilson

- Caterina Fake

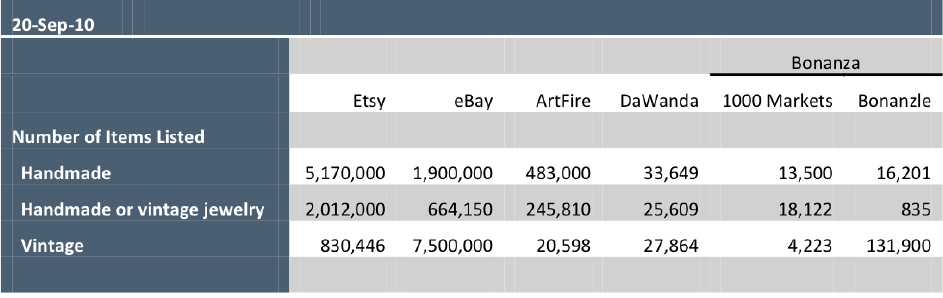

Etsy Competition

Some sites like Etsy are:

- eBay (both through its own service and through acquisition of World of Good)

- ArtFire

- DaWanda (in England, France & Germany)

- 1000 Markets

- Bonanzle

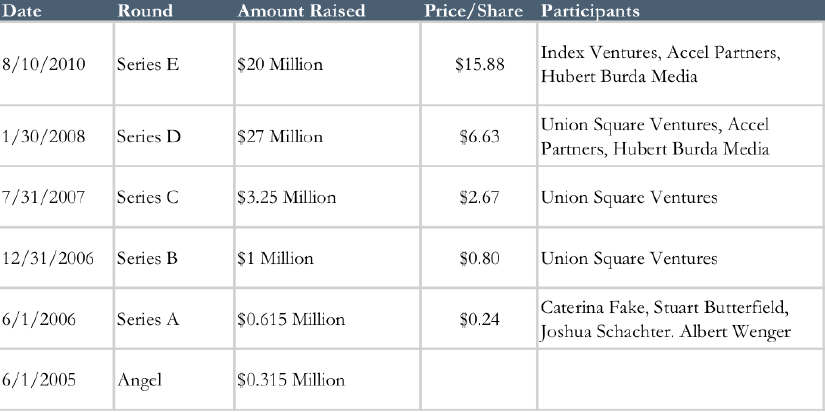

Etsy Financing To Date

Other Etsy Highlights

- 4.4 Million members

- Hired a new COO (Alan Freed) from Google last year who has an emphasis on International

- 2 million of 5 million products are Jewelry

Etsy’s Valuation

- $258 Million (10X Annual Revenues (discounted 15% for lack of marketability))

My Take On Etsy

Fascinating Internet business on the move…a real niche dominator.

My best guess as to what will happen with Etsy: They will go public or be acquired by Amazon (Amazon loves to take out companies when they’re in the $100 million to $500 million per year revenue and if they own a niche).

1 comment so far | Continue Reading »

Thursday, November 11th, 2010

Why Did Ballmer & Others Dump A Record $4.5 Billion In Stock Last Week?

Tweet CommentWhen a super smart guy like Steve Ballmer (he is that smart…I’ve met him a few times) dumps $1.34 billion worth of stock — his first stock sale in 7 years! — I like to dig in a bit

Ballmer was part of a slew of insider stock sales last week, which saw a 2-year high in stock prices.

The volume of insiders selling their stock versus those buying their stock is a good leading indicator of where the stock market might head.

Afterall, if insiders (defined as stock sales by directors, executives or employees of a public company) are selling their own stock, it may be because they believe the stock price has hit a peak (alternatively, they may just need some quick cash).

In more extreme examples, insiders may sell their stock because the company is in real trouble; some speculate that’s what was happening in the below chart (from a decade ago) showing an Enron insider selling a bunch of stock (the blue columns) when the stock price was peaking (the red line).

The news this week doesn’t necessarily involve fraudulent activity but clearly some insiders see the market peaking.

Back to Ballmer…

Ballmer was among executives at 125 companies in the S&P 500 who sold a total of $4.5 billion in stock between Nov. 3rd and 9th… at a ratio of 12 insider sellers for ever 1 insider buyer.

That’s the highest ratio of sellers to buyers on record (InsiderScore has only been tracking the data since January 2004).

The best other explanation for high insider sales is that some insiders may be worried that their capital-gains tax rate for assets owned at least a year will increase from 15 percent 20 percent in January (unless President Barack Obama and Congress extend the 15% rate.).

My take is that the reason for the record insider sales is a combination of insiders thinking that the market may be peaking AND some folks worried that cap gains taxes are going up.

No comments yet | Continue Reading »

Wednesday, February 3rd, 2010

What You Ought To Know About Buffett & Munger’s Four Filters Invention

Tweet 12 CommentsYou guys know I love Charlie Munger and Warren Buffett… I consider them American hereos.

I read an interesting book called The Four Filters Invention of Warren Buffett and Charlie Munger (by Bud Labitan) the other day — if you like business, investing or Buffett or Munger, you should buy this book.

I thought I’d briefly summarize their “Four Filters” below — I paraphrase Bud Labitan’s book at times and add in a dose of quotes I’ve collected (see my past postings on Charlie Munger Quotes or Warren Buffett Quotes) as well as some quotes and insights from other folks.

The Four Filters Invention

1) Understandable First-Class Businesses

- Use The “Scuttlebutt Approach” — Go out and talk to a company’s customers, suppliers and competitors to find out how the industry really works (Philip Fisher wrote about this in Common Stocks and Uncommon Profits (thanks for correcting me, Santosh!)

- Treat Any Investment As If You Owned Only That The Rest of Your Life

- “To understand a business, figure out what results it is achieving, why it is getting those results, and what could happen to change what is causing those results.” — Charlie Munger

- Keep it Simple — Charlie Munger is fond of saying: “We just throw some decisions into the ‘too hard’ file and go onto the others.”

- Read as much as you can about businesses — Buffett and Munger recommend reading annual reports and The New York Times Century of Business by Floyd Norris and Christine Bockelmann)

- “In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time — none, zero.” — Charlie Munger

Circle of Competence

Buffet advises investors to focus on their “circle of competence” (that which they know the most about).

“Draw a circle around the businesses you understand and then eliminate those that fail to qualify on the basis of value, good management and limited exposure to hard times.” — Warren Buffett

2) Enduring Competitive Advantages (Favorable long-term economics) (aka “A Protective Moat Around Their Economic Castles”)

Michael Porter suggests that there are two major types of competitive advantages:

1. A Cost Advantage

2. A Differentiation Advantage

“Something Special in People’s Minds”

Buffett and Munger have simplified this to “something special in people’s minds.”

“American Express has financial integrity; there’s worldwide acceptance of its name. It holds two-thirds of the market while charging more for its product…you have something special in people’s minds.” — Buffett at Berkshire’s 2000 Annual Meeting

“A Moat Around Their Economic Castles.”

“We look for moats around the castle. We think in terms of moats and the impossibility of crossing it — we want it widened every year. If it’s too narrow, we leave it alone.” Buffett at Berkshire’s 2000 Annual Meeting

The strong consumer brands of CocaCola and Gilette (later bought by Proctor and Gamble) were examples that Buffett gave in his 1993 Letter to Shareholders: “The might of their brand names, the attributes of their products and the strength of their distribution systems give them an enormous competitive advantage…”

Here’s another classic Buffett quote on the topic: “I look for businesses in which I think I can predict what they’re going to look like in ten to fifteen years time. Take Wrigley’s chewing gum. I don’t the think the Internet is going to change how people chew gum.”

3) First-Class Management

- Only Work With Good People — “You can’t make a good deal with a bad person” — The Tao of Warren Buffett

- They Should Be Able & Trustworthy — “Ability will get you to the top, but takes character to keep you there.” — Abraham Lincoln

- Good Question To Answer: Does Management Have “Skin in the Game — A CEO should have at least one year’s salary worth of his own money in stock in the company they are running, according to Pick Stocks Like Warren Buffett by J.K.Lasser.

- Management Should Have Their Own “Checklist” — “No wise pilot, no matter how great his talent and experience, fails to use his checklist.” — Munger

4) A Bargain Price

“We look for a horse with a one in two chance of winning and which pays you three to one. You’re looking for a mispriced gamble. That’s what investing is. And you have to know enough to know whether the gamble is mispriced. That’s value investing. Charlie Munger from Poor Charlie’s Almanack.

Margin of Safety — Benjamin Graham called this “margin of safety” — that is, the difference between the intrinsic value of a business versus what the asking price is.

How do you calculate intrinsic value?

Well, I recommend digging into Ben Graham’s Intelligent Investor book for the real details…but if you want a neat little formula than check out this Warren Buffett Intrinsic Value Calculator.

Patience For A Sensible Price Tag — Munger & Buffett refer to waiting for the “fat pitch.” Be very patient, but be very aggressive when it’s time.

12 comments so far (is that a lot?) | Continue Reading »

Wednesday, June 24th, 2009

Financial Crisis Most Wanted Playing Cards

Tweet 8 CommentsThere have been numerous financial crises in our world’s history but the financial meltdown of 2007-2008 will certainly be remembered in the history books.

A clever man named Jason Witt has compiled a list of the 52 key players in the financial crisis.

Why 52, you might ask? Well, to put them on the faces of a deck of cards of course.

Witt, from my neighboring town San Ramon, California, is emulating the success of other Most Wanted Playing Cards such as the Iraq Most Wanted.

I spoke to Jason and he’s a good guy — If you’d like to buy a deck, you can do so here: Financial Crisis Cards.

While this isn’t meant to be a financial crisis blog, I am into business, the media and Wall Street…so I couldn’t wait to order a pack of these for myself and one other for my good buddy Larry the Wall Street Recruiter (Jason says that most people are like me: They’re buying 2 to 3 packs each).

And for those who can’t wait to see who “made the deck,” below is a list of the players that Jason was kind enough to email me. He told me he felt bad about putting Obama in the deck but that he believes that half the country thinks Obama is to blame for the financial crisis.

Without further adou, here are the men Witt thinks made financial crisis history.

The Spades

Ace: Bernard Madoff, Chairman, Bernard L. Madoff Investment Securities

2: Warren Buffett, CEO, Berkshire Hathaway Inc. (WILD CARD)

3: Martin Sullivan, ex-CEO, AIG

4: James Lockhart, Director, Office of Federal Housing Enterprise Oversight

5: Stephen Schwarzman, Chairman, Blackstone Group

6: Stephen Joynt, President, Fitch Ratings

7: Herb Sandler, ex-CEO, Golden West Financial Corp.

8: Vikram Pandit, CEO, Citigroup

9: James “Jimmy”Cayne, ex-CEO, Bear Stearns

10: Timothy Geithner, Secretary, U.S. Department of Treasury

Jack: Christopher Cox, ex-Chairman, U.S. Securities and Exchange Commission

Queen: Deven Sharma, President, Standard and Poor’s

King: Alan Greenspan, ex-Chairman, U.S. Federal Reserve

The Hearts

Ace. George Bush, President of the United States (2000-2008)

2: Jeffrey Immelt, CEO, General Electric

3: Bill Miller, Chairman, Legg Mason Capital Management

4: Ronald Logue, CEO, State Street Corporation

5: John Paulson, President, Paulson & Co.

6: Neel Kashkari, Assistant Treasury Secretary, U.S. Department of Treasury

7: Sheila Bair, Chairman, U.S. Federal Deposit Insurance Corporation (FDIC)

8: Jamie Dimon, CEO, JPMorgan Chase & Co.

9: Rick Wagoner, CEO, General Motors

10: Alphonso Jackson, ex-Secretary, Housing and Urban Development, (HUD)

Jack: Hank Paulson, ex-Secretary, U.S. Department of Treasury

Queen: Barney Frank, Chairman, House Financial Services Committee

King: Ken Lewis, CEO, Bank of America

The Diamonds

Ace: Ben Bernake, Chairman, U.S. Federal Reserve

2: Michael Perry, ex-CEO, IndyMac Bank

3: John Stumpf, CEO, Wells Fargo

4: Christopher Dodd, U.S. Senate, Chairman Senate Committee on Banking

5: Allen Stanford, Chairman, Stanford Financial Group

6: Alan Mulally, CEO, Ford Motor Company

7: Kerry Killinger, ex-CEO, Washington Mutual

8: Charles “Chuck” Prince, ex-CEO, Citigroup

9: Lloyd Blankfein, CEO, Goldman Sachs

10: Phil Gramm, U.S. Senate, ex- Chairman Senate Committee on Banking

Jack: John Thain, ex-CEO, Merrill Lynch

Queen: Jerome Kerviel, Trader, Societe Generale

King: Daniel Mudd, ex-CEO, Fannie Mae

The Clubs

Ace: Jim Cramer, TV Host/Author, CNBC

2: Richard Syron, ex-CEO, Freddie Mac

3: Robert Toll, CEO, Toll Brothers Inc.

4: Ken Thompson, ex-CEO, Wachovia Corporation

5: Stanley O’Neal, ex-CEO, Merrill Lynch

6: Robert Nardelli, CEO, Chrysler

7: Robert Kelly, CEO, Bank of New York Mellon

8: Barack Obama, President of the United States (2008- )

9: Raymond McDaniel, President, Moody’s Corporation

10: John Mack, CEO, Morgan Stanley

Jack: David Lereah, ex-Chief Economist, National Association of Realtors (NAR)

Queen: Angelo Mozilo, ex-CEO, Countrywide Financial

King: Richard “Dick” Fuld, ex-CEO, Lehman Brothers

If you like Financial Crisis Cards, you may also be interesting in buying the Iraqi Most Wanted Playing Cards and America’s Most Wanted Playing Cards.

Disclaimer: I do earn commissions off of products mentioned in this blog.