57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

12 Simple Outlines For Writing A Business Plan

Tweet 1 CommentIf you need to write a business plan I recommend you start with an outline. I found a dozen free templates and have included them below with links to dig deeper. Good luck!

1) Ongig’s Business Plan Outline

The business plan outline I wrote for Ongig (below) was geared towards raising an angel round of funding.The 3 biggest sections were Business Model, Sales & Distribution and Financials.

- Why Should Someone Care (“The Grab” or Executive Summary)

- Company Purpose (In one sentence: the vision/mission stuff)

- The Problem You Are Addressing

- The Solution You Provide

- Why Is This Important Right Now?

1 comment so far | Continue Reading »

Saturday, September 10th, 2011

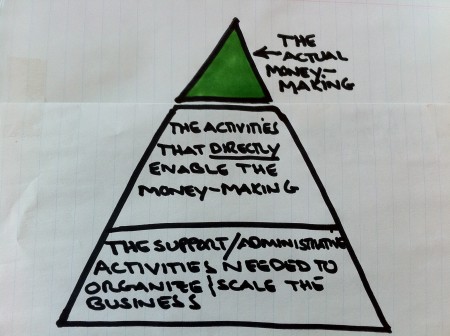

How I Use This Nerdy “Money-Making Pyramid” To Prioritize Business Activities

Tweet 1 CommentAre you leading a business, new or old?

I’ve done both: I’ve started businesses from scratch and I’ve also taken over leading a business that was already a few years into the game.

Either way, the difference between success and failure is what you and your team are working on…and when!

Caution: If you entrepreneurs out there don’t grasp this, your business is very likely to fail (especially my friend who’s spending a couple of hours a week figuring out Quickbooks instead of focusing on making money!).

My marketing-guru friend and previous business partner Eben Pagan inspired the money-making pyramid (he called it the “productivity pyramid” in his awesome GetAltitude “Top Gun For Entrepreneurs” program — it’s a neat visual using a pyramid to illustrate what’s most important to work on in a business.

I’ve riffed a bit so blame me (not Eben) if you don’t like my “Money-Making Pyramid” version.

The money-making pyramid illustrates that the money-making in your business belongs at the top (most important) with the items below it less important the lower down on the pyramid.

1 comment so far | Continue Reading »

Wednesday, September 7th, 2011

Business Is Like A Decathlon: Be Decent At These 10 Things & You’ll Win The Gold!

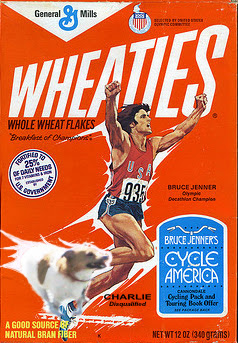

Tweet 1 CommentI’d love to see your face on a box of Wheaties.

The Olympic decathlon — a combined event of 10 different track and field races — is a perfect metaphor for business.

Bruce Jenner didn't have to win every one of the 10 races in the Olympic decathlon to win the gold.

You can actually win the decathlon without being the best at any of the 10 races.

In fact, Bruce Jenner (winner of the 1976 Olympic Decathlon and pictured on the Wheaties box) averaged the equivalent of a little better than 3rd place in each race — and he still won the decathlon by a substantial margin.

Inspired by the decathlon metaphor, here is a 10-item checklist for succeeding in business…if you train to place in these 10 business races, you can win the business gold. …

1 comment so far | Continue Reading »

Friday, July 1st, 2011

The 5 Core Skills Every CEO Should Have

Tweet CommentI’ve begun to notice a pattern of what makes for the best CEO. There are five general CEO skills I believe are most important to being an excellent CEO:

1) Vision…A Clear One

A good CEO must be able to provide a clear vision of what it is the organization is doing.

What makes a good vision statement? As I wrote in 3 Tips On How To Write A Good Vision Statement, it needs to be concise, specific and answer this question for the team:

“Are we working on the right thing?”

Examples of good vision statements include:

“Making the best possible ice cream, in the nicest possible way” (Ben & Jerry’s)

“To provide access to the world’s information in one click.” (Google)

“To provide freedom and independence to people with limited mobility.” (The Scooter Store)

Check out this List Of 50 Awesome Vision Statements I compiled.

2) Mastery Of The Business Model

A good CEO masters the business model of an organization.

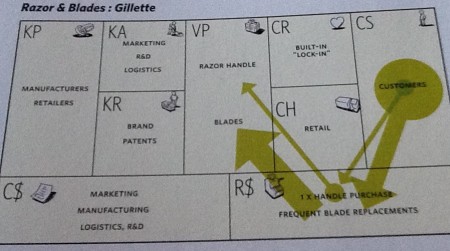

A good CEO knows the answers to the 9 questions in the different sections of this "Canvas."

The above image is of a “Canvas” used to master a business model (in this case, Gillette’s) from the book Business Model Generation.

The Canvas pushes you to answer 9 questions that are imperative to mastering how a business should work.

The 9 questions to answer are represented above by a two letter acronym…such as KP for “Who are your Key Partnerships?”).

If found it most effective to answer the 9 questions in this order:

No comments yet | Continue Reading »

Sunday, July 25th, 2010

5 Steps To Inevitability Thinking (E.g. How To Make It Inevitable That You’ll Generate $20K Per Mo. In Ad Revs)

Tweet 3 CommentsI remember when my friend Eben Pagan shared the concept of Inevitability Thinking with me — it’s such a simple yet powerful approach to achieving your objective…damn, why didn’t I think of that!?

Victoria the Roman Godess of Victory on Wellington Arch

The easiest way for me to share Inevitability Thinking is to give an example (I’m going to use a hypothetical example of an Internet business I want to build).

To do this exercise on your own you would need:

- A Calculator

- Your Brain

- A half-hour or so of time

But, if you want, you can just read my version of this exercise first.

Ok, so here are the steps:

5 Steps To Invetability Thinking

1) Articulate Your Objective

First step is to articulate your objective.

For this exercise, let’s assume your objective is to build a content-based Web site that generates $20,000 per month in advertising revenue.

Sound good?

2) Identify Your Time Frame?

Easy next step: let’s pick a time period to meet your objective of $20,000 in ad revenue per month.

We all want to reach our goals immediately…but let’s be realistic: how does one year sound?

After all, most things that matter in life take time.

One year it is!

3) List Your Inevitability Levers To Achieving Your Objective

Ok, this is still super-easy.

Now you just identify what levers to pull to make it imperative to achieving your objective.

I call these inevitability levers because they are imperative to your objective.

Let’s start at the very top-line of levers you’ll be working with.

For example, to build a content-based Web site that generates ad revenue, you’re gonna need at least these two levers:

A) Advertisements (that are sold)

B) Content (that’s on your Web site)

Note: down below we’ll drill down deeper into a few mini- levers within these inevitability levers.

4) Make Realistic/Conservative Assumptions Quantifying Your Inevitability Levers

You do have to get your hands a little dirty on this one.

Next up, you’re going to start to make assumptions about your inevitability levers.

The key tip about your assumptions is to make them realistic/conservative: afterall, we’re trying to make it inevitable that you’ll achieve your objectives (don’t be overly optimistic).

Let’s start with your advertisements

Assumptions on Selling Advertisements

Advertising revenue is a pretty simple formula: you’ve got to price your ads and you’ve gotta sell your ads.

Let’s start with ad pricing: what’s a conservative assumption we can use on how much you can make from an online advertisement?

Shh, here’s a secret tip on how to track that down: go to a site called “Google.com.”

I searched “average CPM (CPM stands for cost per thousand impressions) of an online ad” and I found that $2.43 is a good average CPM for the Internet as a whole, according to Comscore.

note: I also found a cool graph in this Adify Report that showed CPMs for different vertical markets such as Automotive, Beauty/Fashion, Business, Moms and Parents, Sports, Technology, Travel, Real Estate, Healthy Living/Lifestyle, News and Food (the CPMs in this graph were much higher (average of $7.71 but you want your objectives to be inevitable so lets be conservative and use the $2.43 figure instead).

Ok, let’s use the average CPM of $2.43; if we use that, then that means you’ll generate $2.43 for every 1,000 impressions (aka page views) of your Web site.

To keep things simple, let’s assume that you’re just selling one ad on every page of your Web site.

5) Start Asking Inevitability Questions

Now we need to figure out how much volume of ads you need to sell (since we’re selling one ad per page, we can just call what we’re looking for: “page views” (i.e. each time someone views a page of your content, one ad is served).

Now, bust out your calculator: you want $20,000 per month so you’re going to have to do the following calculation to figure out what would make it inevitable to get enough page views to generate twenty grand:

20,000 ÷ by ($2.43/1000) =

8,230,452 page views that you would need to generate $20,000 in ad revenue.

Ok, now you have to do the same exercise with 8.23M page views:

What would make it inevitable that you would generate 8.23M page views?

The answer: a certain number of “visits” to your Web site. On the Internet, a page view is generated by a visitor visiting your site and looking at a certain number of pages.

Ok, back to assumptions (and don’t forget to be conservative about your assumptions…after all, we’re trying to make it inevitable that you’ll achieve your objective!).

And don’t put your calculator away just yet either!

Visitor Assumptions

So we need to use another assumption for how many pages a visitor would view to continue our math.

You can go Google your particular vertical, but let’s keep things simple and assume that a conservative estimate is that an average visitor will view 5 pages each time they visit your site.

Calculator-time again:

So, if you want it to be inevitable to generate 8.23M page views, then you would need to do this calculation:

8.23M ÷ 5 = 1,646,000 visits

So, if you had 1.65M visits it would be inevitable that you would generate 8.23M page views and thus $20,000 in ad revenue (using your conservative assumptions of course!).

Ok, so now you might ask:

How the heck am I gonna get 1.65M visitors to my Web site (in a month!)!?

Well, you’re probably already thinking of a few different ways such as:

- Buying Ads

- Appearing on Oprah

- Getting Sites to Link to You

- etc.

All are good approaches and you could apply inevitability thinking to any of them…but let’s keep it simple.

Let’s say you believe that your Web site’s content can help you attract traffic (remember, content is your other core lever!).

Content Assumptions

Ok, so how much content would you need to make it inevitable that you would attract 1.65M visitors per month?

Ok, you’re gonna have to make some more assumptions…this time around content.

Here’s where I use my trusty SEOBook tool (see How To Have X-Ray Vision About Your Competition) which will tell me both:

- Number of Visitors To Different Sites

- Number of Pages of Content (at least according to Google & Yahoo whose job it is to index pages on the Web)

Let’s say that you find that on average your competition generates 100 visitors per month for each page of content that they have (by the way, an example of one page of content would be this article you’re reading right now).

Calculator-time again!

So, if you want it to be inevitable that you’ll receive 1.65M visits in a month through content then you’d do the following calculation:

1.65M ÷ 100 = 165,000 pages of content that you would need

Ok, I know, it sounds like a lot of content.

But, remember, this is one year from now.

And, actually, there are tons of Web sites who generate hundreds of thousands of pages of content with little cost (beyond engineering time and hosting cost).

They get their voluminous content from users (aka “user-generated content”) and many of them do it merely by providing a quality bulletin board or question and answer service.

Check out StackOverflow, for example:

SEOBook tells me they have 8 million pages indexed by Google (note: they were founded in 2000 so they’ve been doing this for 10 years)…and they provide this primarily through offering a Q&A service for engineers.

StackOverFlow claims more than 1M visitors every month…now we’re talking!

Ok, so now what would make it inevitable that you generated 165,000 pages of content?

Well, let’s assume for the moment that you’re going to do a blog instead to generate your content.

Conservation Assumptions Again:

Let’s assume that you can write 3 blog entries a day or about 1,000 per year (I’m giving you a couple of weeks of vacation time!)…well, to get to 165,000 pages of content that would take you 165 years!

The oldest living man right now is only 114 so let’s go to plan B.

Well, there are actually free multi-user blogging platforms that allow you to let others blog beyond just you!

So, let’s assume that you can get other writers like you to post 3 blog entries per day (around 1,000 per year with a few vacation days for them too (you’re no slave-driver!).

So, to get 165,000 pages of content through multi-user blogging then you would need:

165,000 ÷ 1,000 = 165 Blog Writers

Ok, so now what would make it inevitable that you could sign up 165 Blog Writers.

Perhaps you have a bunch of Facebook friends or alumni or colleagues who you could talk into helping you blog. But that would be tough for most people so let’s

Did I Mention You’ll Have To Google A Few Things In This Exercise?

Let’s look around for a writers group…Googling “writers group” gives me WriterMag, a magazine with more than 30,000 writers.

Ok, so what would it take for you to convince 160 of those 30,000 writers (.533% of them) to write for your blog (many writers might do it for free just for publicity!).

Let’s assume that you talked to WriterMag’s ad sales team and they told you that they were super-confident that if you ran a full-page black and white ad in their magazine — offering their 30,000 readers free publicity on your blog — every month for six months that it would be inevitable that you would get your 160 bloggers.

Well, such an ad looks like it would cost about $10,000 according to the rate card on their Web site (you can often get discounts to “rate card” and my guess is that you’d get at least 25% off for a 6-month commitment (times are tough for the publishing industry!).

So, a commitment by you of $7,500 should get you the 6 months of full-page ads.

Ok, we’re wrapping it up now.

The gist of this invetability thinking exercise is that:

- If you bought $7,500 worth of ads you could get

- 160 bloggers to create…

- 160,000 pages of content that would generate…

- 1.65M visits per month, which would produce…

- 8.23M page views per month, which could be sold for

- $2.43 CPM, which would make you

- $20,000 per month in advertising sales…

- in one year’s time

This is of course a simplified version of how you’d really conquer your objective (the devil will be in the details and you’re going to have to do your homework on levers, assumptions and the approaches you use).

But the point is: if your levers and assumptions are roughly correct, you will roughly achieve your objective through this approach.

I hope you found this inevitability thinking exercise useful.

Thanks, Eben!

3 comments so far (is that a lot?) | Continue Reading »

Saturday, March 6th, 2010

It’s The Freeconomy, Stupid!: Free As a $300 Bil. Business Model

Tweet CommentI finished a few books on my trip to Europe last week and one of them — Free by Chris Anderson — was chock full of stats that I found myself dog-earing throughout my flight.

“Free” is a must-read if you’re passionate about the Internet, or just business in general.

I’m gonna keep this simple and just list out some good nuggets (which are mostly stats).

Let the “freeconomics” begin!

The “Freeconomy” Is An Estimated $300 Billion Market

The Free Economy is roughly a $300 billion per year market.

By his own admission, Anderson defines this loosely, including revenue generated from businesses driven by giving away most of their products or services (e.g. TV, Radio, online advertising Web sites, etc.).

Two sub-economies have emerged in place of money on the Web (though they can later lead to money)

1) Reputation Economy – This is best measured by Google’s PageRank which rates on a scale of 1 to 10 how important each Web site (and each page on a Web site) is, according to Google’s secret algorithm.

2) Attention Economy – This is best measured by the traffic a Web site receives (traffic being measured by number of visitors and page views)

To calculate the Economic Value of your Web site (i.e. how to help turn your Reputation & Attention into CASH), Anderson suggests this formula:

(The traffic your page rank brings from Google’s search results for any given term) X (The keyword value for that term)

note: while he doesn’t clarify how to calculate “keyword value,” I’d suggest you could use AdWords.Google’s CPC)

General Web Statistics Related to Freeconomics

- The net deflation rate of the online world is nearly 50% (whatever it costs a business to run a Web site now will cost half as much in a year).

- The Web has around one trillion unique URLs, according to one Google estimate

- There are 12 million active blogs

- It costs around $.25 to stream one hour of video to one person (a year from now it will likely be around $.15)

User-Generated Content Statistics

- Around 1 in 10,000 Wikipedia visitors are active contributors.

- YouTube has around one in a thousand users uploading their own videos (meaning the rest are just downloading (viewing) videos

- Most online volunteer communities thrive when just 1% of them contribute

Two Cool Social Media Statistics

- The average number of friends for MySpace members is around 180

- Facebook applications receive around a $1 CPM ($1 per 1,000 page views) for advertising revenue.

Interesting Free-Related Trials & Experiments Anderson Mentions

The Case of $.15 Cent Truffles Versus Cheap to Free Hershey’s Kisses

Dan Ariely (Predictably Irrational) took two kinds of treats: Lindt truffles from Switzerland and Herhey Kisses and offered them for sale to students:

When they priced the Lindt truffles at $.15 and the Kisses at $.01

- 73% chose the truffle

- 27% chose the Kisses

When they lowered both prices by $.01 so that the truffles were $.14 and a Kiss was free

- 69% chose the Kiss

Conclusion: While both products’ prices were lowered by the same amount ($.01), the introduction of free as an option reversed the students’ preference.

How Does “Name Your Own Price” Work As A Business Model?

Matt Mason, author of Pirate’s Dilemma, allowed visitors to his Web site to name their own price upon checkout of downloading his ebook (with $5 via Paypal as the default option)

Results: 6% of the 8,000 people who downloaded the ebook agreed to pay an average of $4.20 each (generating a couple of thousand dollars) (interesting note: Mason estimates he received $50,000 in lecture fees as a result of the publicity of his exercise).

Hope you enjoyed some of these freeconomics!

No comments yet | Continue Reading »

Sunday, May 10th, 2009

A Simple Formula For How Much to Pay for a Customer

Tweet 17 CommentsI’m going to give you a formula to determine how much you should invest to acquire your typical customer.

I call it “Desired Customer Acquisition Cost.” I also saw it referred to as “Allowable Acquisition Cost” in Ready, Fire, Aim: Zero to $100 Million in No Time Flat, an excellent book I recommend by Michael Masterson (I borrowed a couple of his ideas for this article!).

Note: I’m going to write a separate article on customer acquisition strategies, customer acquisition programs, customer acquisition networks and the overall customer acquisition process — please come back for those!

How Much is Your Customer Worth?

Ok, on to your Desired Customer Acquisition Cost.

For starters, you’re going to need to do a few calulations of your own…don’t worry about having the perfect answers — just give it your best shot!

Calculate Your Customer Lifetime Value (aka Gross Sales Per Customer)

You need to estimate the lifetime value of your customer.

Let’s first define customer lifetime value. It is how much a customer will spend with you for their lifetime (i.e. the total number of products they buy from you over time multiplied by the price of each product).

If you’ve been in business already, you might know your Customer Lifetime Value. In fact you could simply divide the total amount of sales you’ve had since you began by the total number of customers you’ve had).

If you’re in a new business, I suggest you research competitors or other similar companies to yours to get a sense of their lifetime value.

For now, if you don’t know what your Lifetime Value is then you could use the range I use: where Lifetime Value is typically about 2X to 6X the price of the first product your customer typically buys from you.

For example, if you customer is likely to pay around $50 for the first product they buy from you, you could expect the lifetime value of your customer to be anywhere from $100 to $300.

Where’s the 2X to 6X range come from? That’s just my experience with businesses I’ve seen. Remember, your business and others can be very different.

Sidenote: If you are selling a subscription-based product (e.g. Netflix, DirecTV, Sports Illustrated) as your first/primary product, then your lifetime value is going to be very different. The lifetime value of a cable/satellite customer may be 10 to 40X the first month’s price since they are likely to stay with their service for a few years (i.e. 10 to 40 months).

We’re going to use a Lifetime Value of 3X for this exercise.

Obama’s Lifetime Value

Let’s pick a fictional company to make this easier…we’ll call our pretend company Obama Enterprises (they sell a set of information products on how to become the next President!).

Obama’s flagship product is a $50 DVD that he’ll ship you on the basics of what it takes to be Mr. President; he has more expensive products that he sells you on the back-end.

So, let’s use $150 (3X the price of his first product) as our Lifetime Value.

Calculate Your Refunds, Cancels, Bad Debt, etc

If your business is like most, your customers will cancel or request refunds, or simply not pay you.

This varies by industry and by business.

For Obama Enterprises, we’re going to assume that 10% of the sales will be refunded, canceled or otherwise just not collected as cash we keep.

So, Obama’s Refunds & Cancels is $15 per customer (10% of $150).

Calculate Your Cost of Goods Sold

First off, most people who know what Cost of Goods Sold is call it “COGS” (sounds cooler, right?).

Here’s the COGS definition:

- The materials cost used in creating the goods plus

- The direct labor costs used to produce the goods

Note: COGS excludes sales, marketing and distribution costs.

COGS varies by industry but are typically in the range of 20% to 50% of the price of your good.

For example, the retail industry is known to mark items up by 100% so in essence their COGS on a $20 shirt is 50% or $10.

In the Software or Internet industry, the COGS is very low (typically just 20% of the sale)…for example, if Microsoft is selling you a software product for $200, it likely only costs them $40 (20% of that) to create/produce.

Since the COGS for Obama’s video product are pretty inexpensive (Discs, box, etc.), we’re going to use 20% of $150 (or $10) as his COGS estimate.

Calculate Your Overhead Costs

Let’s define overhead cost: It’s simply all the costs that are NOT associated with any specific business activity we mention in this article.

Examples of Overhead costs include: Payroll (All Payroll except that included in COGS), Insurance, Rent, Utilities, Legal, Accounting, Travel and Entertainment.

Again, you’re going to have to research your business’s math (or that of your industry if you’re new), but a good rule of thumb is that Overhead will eat up about 33% of your Sales or Lifetime Value (most of this is due to your labor costs).

So, Obama’s Overhead costs are about $50 (33% of $150).

Now, the only other cost we haven’t covered so far is the Customer Acquisition (or Marketing) cost…we’re going to skip that for now as that’s what we’re trying to determine.

Calculate Your Desired Profitability %

Let’s skip to how much profit you want.

Profit is how much money you want to keep after all expenses (except taxes) are paid…you know it as the “bottom line” (Google and Microsoft tend to keep a profit of 20% to 30% while other businesses are more modest with a profit of 5% to 10%).

Obama’s people are not greedy, so we’re going to pick a profit goal of 10% for Obama Enterprises.

So, Obama’s Desired Profit is $15 per customer (10% of $150).

Ok, now for the good part. Here is how you calculate your Desired Customer Aquisition Cost:

Desirable Customer Acquisition Formula =

- Lifetime Value minus

- Refunds & Cancels minus

- COGS minus

- Overhead minus

- Desired Profit

So the formula for Obama’s customer acquisition is:

- $150 Lifetime Value minus

- $15 Refunds & Cancels minus

- $30 COGS minus

- $50 Overhead minus

- $15 Desired Profit

…And thus the amount Obama can spend to buy one customer, drumroll please, is…

= $40

And There You Have It (Your Desired Customer Acquisition Cost)

So, if our assumptions are ballpark-accurate, Obama can go out and spend an average of $40 to acquire each customer who buys his $50 DVD product, and still have all his expenses paid and a desired profit of 10% of all he sells.

For example, he could offer to pay you $40 for each customer your Web site sends over to his…and if you sent him 1,000 customers, he would gladly pay you $40,000 (1,000 times $40) because he would eventually receive about $150 in Lifetime Value from each of those customers and eventually receive a profit of $4,000 (the 10% Desired Profit he calculated) on his partnership with you.

Caveat here (which you probably already figured out):

Since Lifetime Value is over time, Obama has to make sure that he has the proper cash flow to afford to pay all bills while he earns the lifetime value for customers.

That’s called “Cashflow” or “Working Capital” and it has to wait for another day!

Though, if you want to improve your creditworthiness (so you can get better/larger loans or credit card limits), you should read How to Boost Your FICO Score.