57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

The 7 Unusual Fundraising Lessons I Learned While Raising $1 Million +

Tweet 4 Comments[Warning: This post is geared for high-integrity people; if you’re dishonest, please don’t bother reading on or raising money from anyone.]

I’ve raised money twice: $1 million for ExpressDoctors (a flop) and $350,000 for Mojam (which got sold and is still around!).

I’m by no means a pro — you’ll find many others with more experience — but I don’t see too many of them writing about their experience.

I enjoy sharing my learnings with others in hopes of creating more awesome businesses, non-profits or other organizations in our Universe!

I’m leaving out the “Fundraising 101” type tips such as: Define the uses of the money you need; investing takes longer than you think; have a good business plan, have a name-brand/or trustworthy bank and law firm to process paperwork, etc. — you can find those tips anywhere.

My tips are, hopefully, a bit outside the box.

7 Tips On How To Raise Money

1) Create An Investor Pipeline

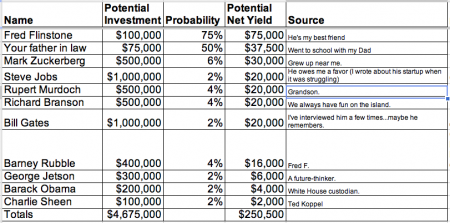

Crafting an investor pipeline is an easy and effective way to help raise money.

The reason you need to create a pipeline is …

4 comments so far (is that a lot?) | Continue Reading »

Friday, July 30th, 2010

What Makes A Good Startup Entrepeneur by Ron Conway & Paul Graham

Tweet CommentFun panel at today’s CrunchUp with:

- Paul Graham, YCombinator

- Ron Conway, SV Angels

- Michael Arrington, TechCrunch

Here are notes of my favorite nuggets:

Ron Conway on data about his 500 startup investments:

- “The success rate in our portfolio is going from 10% to 15% right now…because of the$25 million to $50 million M&A deals.”

- Failure Rate was 77% leading up to the Internet Bubble of 2001…and now is about 40% post bubble (2002 to today)

- “Repeat-entrepreneurs” have about a 66% rate of success in their second startup.

- Deal flow did not decrease during mortgage bubble.

- Entrepreneurs have the same level of success regardless of the climate.

Check out Ron Conway data here for more on the data from his deals)

Here are some more Ron Conway thoughts:

- “Getting your money back( (from an entrepreneur) is not a bad deal”

- Shawn Fanning is one of the top entrepeneurs he’s worked with.

- Mark Zuckerberg…has grown in maturity and saaviness of being a leader…”on an algorithmic scale.”

- Great defining companies are being created at a much quicker rate than they were 10 years ago. Awesome news for entrepreneurs.

- An ideal entrepreneur is a little bit crazy (crazy-smart) is good

Paul Graham on ideal size of a a founding startup team:

- 2 and 3-person startups are the best

- 1-person startup is the next best

- 4-person startup is the worst

Michael Arrington: Facebook is offering one-tenth of a percent of equity to top of the top engineers.

Check out Ron Conway’s Three-Megatrends of The Internet to see what markets Ron Conway is interested in.

No comments yet | Continue Reading »

Wednesday, July 21st, 2010

Here Are The 5 Major Stages of Startup Funding

Tweet 6 CommentsA friend of mine recently asked me about the different stages of startup financing — so I figured I’d write it down for you too!

There are certainly other sources of startup capital besides the ones listed below, but these five are the top ones; and they’re typically used roughly in the order I list them.

5 Stages of Startup Funding

1) Seed Capital

This is typically the very first investment of money used to for market research and developing product.

It can come from the founder’s personal savings (e.g. from a severance package from the founder’s prior job) or from acquaintances (aka a “Friends & Family” or “F&F” Round).

Seed capital can be received as a loan on in exchange for common stock.

Note: Credit cards/American Express are also used as a startup fund option around this time.

2) Angel Investor Funding

Since seed capital is sometimes limited, it is often necessary for an entrepreneur to tap into wealthy individuals outside their friends & family — this is often called an “Angel” investor.

You can receive money from an angel investor as a loan that is convertible to preferred stock (often it converts to the Series A round of stock below).

Friends & Family investors sometimes participate in this “Angel Round” of financing.

3) Venture Capital Financing (Series A, Series B, Series C Rounds, etc.)

Venture capital (VC) funding is typically used by companies that are already distributing/selling their product or service, even though they may not be profitable yet.

If the company is not profitable, the venture capital financing is often used to offset the negative cash flow.

There can be multiple rounds of VC funding and each is typically given a letter of the alphabet (A followed by B followed by C, etc.)

The different VC rounds reflect different valuations (e.g. if the company is prospering, the Series B round will value company stock higher than Series A, and then Series C will have a higher stock price than Series B).

If a company is not prospering, it can still get subsequent Series-rounds of financing, but the valuation will be lower than the previous series: this is known as a “down round.”

These rounds may also include “strategic investors:” investors who participate in the round and also offer value such as marketing or technology assistance.

In the Series A, B, C, etc. rounds of financing, money is typically received in exchange for preferred stock (as opposed to the common stock that insiders/seed capital sources (and perhaps even angel investors) receive).

If you want to learn some tips on VC funding, check out my How To Raise Money From A VC: Insider Tips article.

Note: A line of credit from a bank is another startup fund option around this time as well.

4) Mezzanine Financing & Bridge Loans

At this point, companies may be eyeing the following types of opportunities that require additional funds:

- An IPO (initial public offering)

- An Acquisition of a Competitor

- A Management Buyout

To do so, they can tap into mezzanine financing or “bridge” financing.

Mezzanine financing is often used 6 to 12 months before an IPO and then the IPO’s proceeds are used by the company to pay back the mezannine financing investor.

5) IPO (Initital Public Offering)

Finally, companies can raise money through selling stock to the public in what’s called an Initial Public Offering…or IPO.

The IPO’s opening stock price is typically set with the help of investment bankers who commit to selling X number of the company’s shares at Y price, raising money for the company.

Once the stock is out, it is traded through a stock exchange (like NASDAQ or American Stock Exchange).

Companies can offer more of their stock through additional offerings.

6 comments so far (is that a lot?) | Continue Reading »

Monday, April 26th, 2010

Ron Conway's Three Mega-Trends of The Internet

Tweet 3 CommentsIf you want to know what arguably the most successful angel investor is focusing on these days, check out this Interview of Ron Conway on TechCrunch

He discusses three “Mega-trends” along with some of these highlights:

1) Real-Time Data — Any company that employs crowd-systems.

This is the category for 70% of Conway’s current investments

Examples of real-time data companies Conway has invested in are Twitter, Four-Square and Hunch. Quora (which Ron didn’t invest in) is another example.

2) Growth of Facebook and Twitter — Social media is here to stay.

“The social phenomenon is consumers’ willingness to share more…including sharing where they’re at.”

His comments regarding Facebook

“Facebook’s revenues of hundreds of millions of revenues make it “a very real company.”

“Facebook is becoming the Web — everything you need is there. It’s a walled garden the way AOL used to be…except in this Walled garden, everything is there.”

His comments regarding Twitter

“Ads could be more relevant on Twitter than anywhere on the Web.”

3) Social Commerce or Flash Marketing/(or Flash Sales)

Examples include Guilt Groupe, Groupon, etc.

Conway points out that these are also all real-time data companies.

Conway had an interesting observation about when startup founders (companies like Twitter or FourSquare) should sell out:

“The older I get the more I want to see entrepreneurs (like Twitter founders) play it out…see how big you can get on your own.”

3 comments so far (is that a lot?) | Continue Reading »

Saturday, March 13th, 2010

How To Raise Money From A VC: Insider Tips

Tweet CommentI’m sitting in on a packed breakout session at the SxSW conference with Charlie O’Donnell of First Round Capital.

If you’re interested in creating technology-driven businesses, you should know about Charlie.

I like Charlie because he’s worked both sides of the fence (founder/CEO of businesses and venture capitalist); and he’s extremely well-networked .

His current employer First Round helps entrepreneurs with their early financing (before the big venture capitalists get involved).

Note: If you want to know more about the different stages of raising money, check out The 5 Major Stages of Startup Funding article I wrote.

Think of them as a “feeder fund” to the larger investors. If you can sell First Round on investing in you, you’re about 100X as likely to get larger funding from more venture capitalists.

Here are some tips he shared with entrepreneurs:

Ask For Advice (not money)

He says: “If you ask for advice (from venture capitalists), you get money…if you ask for money, you get advice.”

Vet Your Product/Product Management is Key

Most startups have a biz person and a techie…but it’s the translation in the middle that’s key (someone to focus on what the milestones are, priorities, etc. for the product).

Simple things like getting wireframes of your products nailed down before you start coding can be a huge time saver.

“The best ideas are the ones that nobody thought would work.”

Everyone is good at coming up with feature ideas…it’s a lot tougher to pick the ones to prioritize on.

So, be very clear about who is in charge of product management.

Things Take Longer And Cost More Than You Think

Building a company will take three times as long and cost twice as much; or take twice as long as cost three times as much.

Have 2-Week Plans (not 6-month plans)

Focus on Small/Short Milestones

This is tougher but will make you more efficient. Again, this is where someone with product management is key.

Hiring Is Harder Than You Think

On-boarding is harder and takes longer than you think. A programmer, for example, takes awhile to get to know your systems.

Venture capitalists, O’Donnell adds, don’t always help: “VCs look only at top-level employees…and never ask details about lower level hires.”

Embrace Failure

Find people who have failed in your space because they’ve learned the most — don’t just talk to people at a successful company like Twitter.

You Might Consider Selling Customers First, VCs Later

It’s way easier to ask a venture capitalist for money than it is to ask a customer…but you should focus on getting sales from customer to increase your leverage with VCs.

For example, Square Space in New York focused on generating sales (as opposed to raising money from VCs) and is now in a position of greater control with raising money from VCs.

Launching Products/Businesses

PR is really hard to do…there are not that many people who do it well.

You may get a bunch of public relations on the launch day, but it will be much tougher to get PR a few months later (unless you have a new milestone) — again, having greater frequency of milestones is a theme here.

Building a Startup Is All About “Unfair Advantages”

A key leverage point with VCs is your “unfair advantages.”

Examples of unfair advantages:

- You worked at the #1 competitor and you know the inner-workings of that company like noone else.

- You have visibility in the community and folks will want to work with you.

For example, Gary Vaynerchuk can jump on his Wine Library video blog right now and get a developer hired immediately — that is a good “unfair advantage” he has over his competition.

3 Must-Haves To Attract A VC

- Solid Team

- Market The VC Wants to Play In

- A Strong Product

Caution: Don’t Idealize Strategic Investments

Don’t assume that when a strategic investor puts money in you that you’ll get everything from that company that makes sense.

He points to his startup Indeed raising $1 Million from the New York Times and assuming that the newspaper would promote Indeed on its highly-trafficked Jobs Web pages (which it wouldn’t do).

Start The Wind-Down Process Early

When you’ve raised venture capital and your business isn’t working out, leave yourself enough time to sell your assets.

That’s because the “wind-down” period of a business goes very fast and selling your remaining assets takes time and energy.

No comments yet | Continue Reading »

Sunday, November 15th, 2009

How to Raise Money Using a Bridge Loan or Convertible Note

Tweet 17 CommentsIf you’re raising money for your business from friends and family or angel investors, I recommend you consider using a convertible note or bridge loan to do it because it is typically cheaper and quicker than raising a “priced” round (in which you sell stock at a certain price).

Here are the main things you need to know about bridge loans/convertible notes:

Q: What is a bridge loan (or convertible note)?

A bridge loan/convertible note is simply interim financing until the next round of financing can be obtained. The word “convertible” is often used since the bridge loan will “convert” into equity at your next round of financing.

Q: Why use a bridge loan/convertible note versus selling stock?

- It typically costs you less than selling actual stock — You can get a bridge loan administered for a couple of thousand dollars or less.

- Fewer attorneys involved — Investors are less likely to ask their counsel to review it .because it tends to be a shorter document that is less complicated than a stock agreement.

- You don’t have to set your valuation yet — A bridge loan is simply a loan that will convert into equity later when a valuation is set (typically during a larger round of financing).

Q: During which stage of financing is a bridge loan/convertible note most useful?

I find them most useful during the initial seed financing rounds of fundraising such as taking on a small amount of money ($500,000 or less) from private angel investors or friends and family (as opposed to venture capital firms).

Q: How long should a bridge loan be for? (what should the length of the term be?)

It will typically be one year or less (it should be timed such that the maturity date of the bridge loan is due roughly around the time that another financing (or liquidity) event occurs for the company.

Q: What should the interest rate for a bridge loan be?

A: The interest rates for convertible bridge notes vary but tend to be around five percent greater than the Federal Reserve rate (one point of reference: California laws dictate that there should be a cap of 10% on the bridge note interest rate).

Q: What happens if you reach the maturity date of a convertible promissory note and there hasn’t been another round of financing or liquidity event (and your company doesn’t have the money to pay back the loan)?

In this event, you can:

1) Ask the investor to extend the maturity date

2) Convert the loan into stock based on a price you pre-determined or a price you determine at the maturity date.

Q: What is a conversion discount (or warrants) for a bridge loan?

A “conversion discount”(or warrants) is a future discount that you provide to your investor (the person giving you the bridge loan) in the event that you do raise another round of money or have a liquidity event.

The conversion discount generally ranges between 20% and 40%.

So, for example, let’s say you get your bridge loan and offer a 30% conversion discount and then later you raise a Series A round of venture capital at $1 per share. Your bridge loan investor would then receive one share of stock for each $.70 that he loaned you.

Q: Do you have an example of a convertible note/bridge financing term sheet?

Here’s one: Convertible Loan Term Sheet

Q: Are there any drawbacks to taking a bridge loan?

If you take a bridge loan and can’t pay it back at maturity then an investor can technically use that as an “event of default” which could lead to bankruptcy — the way around that is to accept the bridge loan from someone close to you who you trust to see you through such a scenario.

Additionally, to protect yourself, you can try to get language into the bridge loan which converts the loan into something else (no matter what).

Final Thoughts

If you want to read more about bridge loans/convertible notes (which are also called “convertible promissory notes”), a great resource can be found at Convertible Notes by Yokum Taku, an attorney at Wilson Sonsini Goodrich Rosati (WSGR) in California, USA.

I have worked with the WSGR law firm on one of my startups and highly recommend their services. In fact, one of their attorneys was so good, I eventually hired him as our general counsel!

17 comments so far (is that a lot?) | Continue Reading »

Tuesday, June 30th, 2009

Entrepreneurial Tips From Four Venture Capitalists

Tweet 1 CommentI sat in on a venture capital panel at earlier this month at eBay’s DevCon at San Jose headquarters. Below are some highlights.

Here’s the panel:

Sergio Monsalve, Partner, Northwest Venture Partners

- Five years at eBay; then went to PhotoBucket

- Last fund was $650MM

- Nothwest focuses on investments of $1MM to $50MM (sweet spot is someone who has a product with traction (perhaps early revenue or no revenue)

Rob Hayes, Partner, First Round Capital

- Background includes Pam, Geoworks, Go Corp, Japan External Trade Organization

- First Round focuses on investments less than $1MM investments (from 2 to 20 people) (likes to invest in companies with “two guys and a dog.”)

Ravi Mohan, Managing Director, Shasta Ventures

- Background includes Accentutre, Hyperion, MIC (in India) and McKinsey

Mark Gorenberg, Managing Director, Hummer Winblad

- Background includes Sun Microsystems

- Has sat on many boards including Omniture, AdForce, HomeGrocer

(The questions were asked by Moderator Charline Li, Founder of Altimeter Group)

Where do you see the new opportunities to invest your venture capital?

Mark: We see four trends:

- Common Inventory Model

- Commerce on the Internet is Blending With Offline — We invested in Crillian Krillion — eight or nine percent of people want to shop online but want to pick it up in the store.

- MobCommerce — Wisdom of the crowds.

- Analytics is Now Just Table Stakes — (Mark invested in Omniture). Every company has to have core analytics.

Ravi: The word is commerce. Not just e-commerce. Where do people want to buy?

I believe the mobile device is the platform to bring that together.

The second thing is that everything that is happening in the offline world, is increasingly happening in the online world.

Rob: One of the themes we invest in is the Implicit Web. People don’t really care where they buy things from. If I can reach into ebay though an API, Amazon through an API, etc…where can I put all this data together to tap into all this?

E-commerce used to be about getting the best price. Now it’s more about getting the best experience.

That’s why we’re invested in BazaarVoice— Companies have to get used to people saying bad things about them online (even on their own Web site).

Sergio: There’s a trend of big companies working with small companies.

I think we’re in the third inning of e-commerce. It’s now that the incumbents (big companies like eBay) are starting to reach out with small companies to have symbiotic relationships.

We’re seeing a lot agencies investing with us.

How does an entrepreneur get venture capital funding

Rob: If it’s a really good idea in a really big market with a really good team (and can they pivot when things don’t go exactly according to plan).

Mark: I think you’d be surprised at how many of us fund things that really early. We funded Ace Metrix even though we’d never met them. They had really done their homework.

Ravi: There are a lot of great business ideas…as entrepreneurs you have to really look at the market size and how disruptive your idea is.

Sergio: The question of pivoting is important to underline. I see innovation…as continuous innovation throughout the life of a company. If you look at a company like RackSpace (now a $1.5 Bil. market cap) the defining moment was not when they started the company…it was in 2001 during the meltdown.

Look at Qumranet (a year before selling to Red Hat) they completely scratched their plan. The market wasn’t there…so they were able to pivot the company and then get sold a year later (for $107MM).

When’s a good time for an entrepreneur to look for venture capital funding?

Mark: With Arbor Software — we talked to them when they were really young…we worked together for six months and we funded the company six months later.

Ravi — Plastic Jungle (an online exchange for gift cards) — we met with them last summer and it was a complete offline business. We began looking at the vision and what this could be.

Gary Briggs (eBay’s ex CMO) was an advisor and we started to look at it together. The whole process took seven to eight months. During that time we helped expand the vision of the company and bring in additional team members.

What are some alternatives to venture capital funding?

Mark: Bootstrapping is natural. The lines between angel and venture firms has really blurred. Angels have seen 30% to 40% of their net worth go away. As a result, we (VCs) are seeing entrepreneurs earlier.

What do you think about exit scenarios (liquidity events) for startups these days?

Ravi: You need to build a business that is worth something. I’m thinking of a business that will reach $100MM and is growing 20% to 30% with EBIDTA of 20% to 30%…and then apply 10 to 30 cash flow multiple.

If there is no exit, then we may end up dividending the cash to management and investors. Or sell to private equity firms.

Rob: I believe that we’re going to see a lot of exits between $50MM and $100MM. So, if you’re going for the billion dollar company exit, you should be talking to venture capitalists.

An entrepreneur with a $50 million exit could be taking care of their great grandchildren.

Ravi: Rob and I are invested in a company called Outright, a free accounting service — everything that a small business doesn’t want to do. One of our target markets is ebay sellers.

Now we’re going to roll Outright out on ebay Selling Manager in August or September.

Would you invest in a company that has done a DPO (Direct Public Offering)?

Mark: We tend to shy away from that. We like clean paperwork…private stock only.

What’s the biggest mistakes entrepreneurs make?

Rob: Not taking enough money. Entrepreneurs get so tied up in the dilution math. It’s the most painful thing.

Mark: Entrepreneurs saying they have no competition. That’s indicative of not doing enough homework.

Ravi: It’s market size. Just being intellectually honest about the market size is important.

Sergio: There’s a balance between optimism and being intellectually honest that is needed.

1 comment so far | Continue Reading »

Monday, April 27th, 2009

How I Boosted My FICO Score By 162 Points…To 778

Tweet 156 CommentsI used to have poor credit.

And if you’re like me, you’ve had to fund some or all of your business on credit. When I ran Mojam.com, I had to use cash withdrawls off of five credit cards just to meet payroll for a month or two!

Unfortunately, I was a dumb kid back then and didn’t pay back the loans fast enough (causing poor credit!).

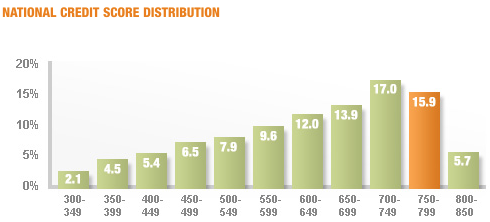

Here's where U.S. folks fall on their FICO score (source: CreditKarma)

So, below are some learnings from restoring my credit.

First off, this article focuses on how to maximize your opportunity to get personally-guaranteed credit…so it’s useful if you A) Run a small business where you have to personally gurantee your credit cards or B) Want to improve your credit outside of business (e.g. for mortgage or automobile loans).

Ok, first off, how do you measure your credit? — Currently, one matters more than all others: Your FICO score. FICO stands for Fair Isaac Corporation, a credit-scoring business that works with the three major credit bureaus (Equifax, Experian and Transunion) monitoring people’s credit.

FICO scores range between 300 and 850 (the higher being better) with a score of:

- 760 or better being Excellent (you’ll get offered the lowest loan rates with flexibility)

- 700 to 759 being Very Good (you’ll be offered above-average terms)

- 680 to 699 being Good (average terms)

- 620 to 679 being OK (you’ll be offered below-average terms)

- Below 620 — If you’re below 620 it is very uncertain what kind of loan you’d be offered, especially these days

FICO doesn’t make you loans but they provide the report card — the FICO Score — for others who do.

So, you might ask: How do I fix my credit?

Well, it’s based on a secret algorithm that changes all the time (sort of like Coke’s recipe or Google’s algorithm).

This article is sort of like reverse-engineering FICO.

I asked Scott Jones, a credit repair expert I worked with at CreditLine, to talk about the key ingredients of FICO’s secret recipe and how important each ingredient is (the % in parentheses). Here’s what he said:

Your Payment History (35% of score)

Basically, paying on time helps lift your score, while paying late, liens and bankruptcy will lower it.

The Amount You Owe (30%)

Keep your balance low to zero. Lenders don’t like to see you using up all your credit on your credit cards (i.e. letting the balance get high) so if you can keep it low (or, better yet, pay it down to zero), you’ll get some points for that.

The Length of Your Credit History (15%)

The longer you have a credit card the more points you get on your FICO score. Even if you use a credit card just sparingly (like me with my Mervyn’s Card), you get some good FICO points for just having it for a long time.

New Credit Inquiries (10%)

This one is interesting: When you apply for a loan (including getting a credit card), the company providing you with credit (i.e. Visa or Mastercard or AMEX or a department store or mortgage company or Auto Dealership) makes what is called a “New Credit Inquiry” with the credit agencies to see what your credit looks like. Each new inquiry can LOWER your FICO score (my guess is by 10 to 30 points) for a short amount of time (about three months); so, be careful not to take out a few credit cards at one time.

Get the Right Types of Credit (10%)

Different credit is measured differently. Below is one credit expert’s prioritization of which types of credit in order of importance (first being most important).

- Home loans

- Car loans

- Major credit cards (Visa, Mastercard, AMEX)

- Department store credit cards

- Student loans

Here are some other tips & final notes:

- You Start Off Pretty Good — When you first get a FICO score (18 years old appears to be the minimum age to get a credit card) you start off from a position of strength! Since 30% of the FICO score depends on money you owe, my guess is that you start off with a FICO score somewhere in the 600 range.

- Be Maniacal about paying all of your bills on time — I don’t mean to scare you, but I once paid a Macy’s credit card bill 60 days late and it cost me about 50 points on my FICO score!

- If You Carry a Balance on Your Credit Card — If you must hold a balance on your credit card (I recommend that you don’t) then try to keep it to half or less of your available credit.

- Don’t Do Debt Consolidation — Credit consolidation (putting all your debts onto one credit card) is usually a bad idea (unless the other card is lower interest and you can pay THAT balance off within a year).

- Own just a few credit cards (I think 2 to 5 cards seems right) and use them once in awhile and pay them off immediately when you do.

- Don’t Cancel Credit Cards — I don’t believe that canceling credit cards can help your FICO score and it can definitely hurt it (because of the Length of Credit History piece)

- If you ever get billed for something and you believe that you do not owe the money, you should IMMEDIATELY contact the biller and straighten it out (and make sure it’s corrected by Experian, Transunion and Equifax).

If you’re like me and you made a bunch of mistakes already, you can repair your credit but it takes time. A Couple of Options:

Do it Yourself — You can get free online credit reports from all three agencies at CreditReport.com and you should! Go to Check out the details of each (they will list each one of your credit cards or loans) and if you can find an incorrect piece of info or an inconsistency among the three agencies (one of them reports that you were late on paying your AMEX card and the other two do not), then write a “letter of correction/deletion” to try to fix your credit report.

That doesn’t harm you and typically can turn into them correcting/removing the item in a way that positively impacts your credit

Use a Credit Repair Service — I used a service called CreditLine and I ended up increasing my score from 616 to 778 within two and one-half years; an average of about 15 points every three months.

I used their premium service and it was worth every penny. It helped me get bettter terms on my car loan and gives me piece of mind about getting a loan for a anything else in the future. They also provided me with phone-based credit counseling.

Either way, make sure you’re in tune with your FICO score, apply what tips you can and good luck with your credit restoration.

Question for you: Do you know how credit works outside the U.S.? If you do, please comment below with any tips you have — thanks!