57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

The Law of Scale (the benefits are “Ungodly Important”)

Tweet CommentIn his epic commencement speech to the USC law school grads in 1994, Charlie Munger mentions “scale” 24 times.

The advantages of scale are “ungodly important”, he points out.

Benefits of Scale = Lower Costs, Higher Prices & Bets on New Markets

Benefits of scale include reducing costs, raising prices and testing new markets.

In a beer business, for example, Anheuser-Busch operates at such a higher volume than Anchor Steam beer (based in San Francisco), that …

No comments yet | Continue Reading »

Saturday, July 30th, 2011

The 7 Unusual Fundraising Lessons I Learned While Raising $1 Million +

Tweet 4 Comments[Warning: This post is geared for high-integrity people; if you’re dishonest, please don’t bother reading on or raising money from anyone.]

I’ve raised money twice: $1 million for ExpressDoctors (a flop) and $350,000 for Mojam (which got sold and is still around!).

I’m by no means a pro — you’ll find many others with more experience — but I don’t see too many of them writing about their experience.

I enjoy sharing my learnings with others in hopes of creating more awesome businesses, non-profits or other organizations in our Universe!

I’m leaving out the “Fundraising 101” type tips such as: Define the uses of the money you need; investing takes longer than you think; have a good business plan, have a name-brand/or trustworthy bank and law firm to process paperwork, etc. — you can find those tips anywhere.

My tips are, hopefully, a bit outside the box.

7 Tips On How To Raise Money

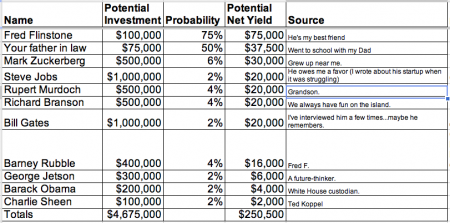

1) Create An Investor Pipeline

Crafting an investor pipeline is an easy and effective way to help raise money.

The reason you need to create a pipeline is …

4 comments so far (is that a lot?) | Continue Reading »

Thursday, May 12th, 2011

The Top 100 Mental Models Needed To Succeed In Business

Tweet 22 CommentsI’m fascinated by these models, and their application to business (not just investing) and life, and decided to keep a list of ones I run across (some are related to Munger and others I’ve learned about elsewhere (but believe Munger might appreciate)).

Warren Buffett's Right-Hand Man Charlie Munger