57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

LinkedIn IPO: Highlights From Their S-1 Filing

I’m one of those weird guys who likes to pour through documents like the 182-page LinkedIn S-1 Registration Statement (while flying to Salt Lake City for a trip with high-school buddies!).

An S-1 is what a company files in preparation for “going public.”

Here are some highlights:

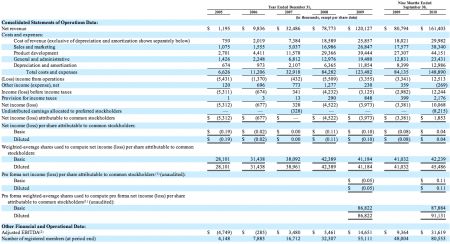

Estimated LinkedIn Revenue & Profits in Calendar 2010

- Revenue: $215 million

- Net Income: $13.4 million*

This excludes what looks like an $8.2 million payout to preferred shareholders

LinkedIn Revenue Growth*

- 2009 to 2010: 99.7% (impressive that they doubled in the last year)

- 2008 to 2009: 53%

- 2007 to 2008: 142%

* 2009 to 2010 reflects just 9 month periods.

LinkedIn Revenue Breakdown By Product Line*

Hiring Solutions: 44% — Recruiters (3,900 of them in 2010) pay LinkedIn to access and market to its database of users. This includes 69% of the Fortune 100.

Advertising: 31% — Marketers (33,000 in 2010) run ads on LinkedIn’s page views.

Subscriptions: 25% — LinkedIn members can use much of LinkedIn for free but there are additional things that users must pay for (such as seeing more than 100 results at a time or being able to filter your searches by seniority of a LinkedIn member).

*Breakdown as of quarter ended Sept. 30, 2010

“LinkedIn is not as automated a business as some may think…over half their revenue comes from Field Sales.”

LinkedIn Revenue By Sales Channel

- Field Sales: 54%

- Online Sales: 46%

Due in part to LinkedIn’s money spent on a sales team in the field, their profit margins are lower than Google’s and Facebook’s.

“I bet that Groupon’s profit margins will be closer to LinkedIn’s than they are to Google or Facbeook when Groupon files its S-1…due to the large field sales team they employ. “

Did anyone notice that I just quoted myself? I’m just trying to break up the text components here!

LinkedIn’s Profit Margins*

- Gross Margin: 81.4%

- Adjusted EBIDTA: 19.6%

- Operating Margin: 7.8%

- Profit Margin: 6.2% (this compares to 28%+ for Google and a rumored 25.7% for Facebook)

* For the 9 months ended Sept. 30, 2010

Interesting Stats On The LinkedIn Database*

- 90 Million+ members

- 1 million+ companies listed

- 2 million+ groups

- 25,000 jobs were posted per week (on average) during 2010

*As of December 31, 2010

LinkedIn Traffic Per Quarter (end of 2010)

- 65 million unique visitors

- 5.5 billion page views

LinkedIn’s International Business

- 27% of net revenues come from outside the U.S.

LinkedIn Valuation

LinkedIn is currently being valued at around $2.9 billion according to the latest shares being sold on SharesPost (note: this is not in the S-1 Registration).

A LinkedIn IPO could value the company at a great price than the $2.9 billion based on those recent privately-traded LinkedIn shares.

Of course, the LinkedIn valuation could change big time if we have an Internet bubble burst before they go public.

Tweet 2 Comments