57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

Are These 7 Items Pointing To A Coming Economic Armageddon?

I’m an optimist by nature but — hopefully you see that through the rest of my articles here — but I’m also practical.

And there’s a weird amount of $hit going on in the U.S. and abroad these days that’s got me preparing for a possible economic meltdown.

And I’m not talking about the staggering U.S. federal deficit — that’s got serious longer-term consequences. I’m talking about a handful of other scary items that worry me more in the short-term.

The “Lollapalooza Effect”

Whenever there are a large number of major variables at play, the chances of a majorly positive or negative event goes way up.

Charlie Munger (Warren Buffett’s right-hand man) uses the term “Lollapoalooza Effect” to describe these types of situations.

Take the recent Earthquake in Japan — it caused a tsunami which causes a nuclear power-plant melt-down and now there are aftershocks (earthquakes and otherwise) impacting Japan in unforeseen ways (see “Inflation” below for the additional ripple effects from Japan’s woes).

Lately I’ve been observing an unusually high number of variables in play — no single one of them is going to bring us to an eeconomic meltdown — but with a handful of them occurring at the same time, I believe that there’s an increased chance of a negative Lollapalooza Effect on the U.S. economy.

The Lollapalooza music festival is a fun event; A Lollapalooza Effect of major negative variables is an economic crisis

Am I saying that we’re likely going to have an economic armageddon?

No.

But I do think there is about a small (perhaps 10%) chance the U.S. could have a financial (and morale) meltdown within the next 10 years.

And 10-to-1 odds are pretty scary when you’re talking financial armageddon!

Disclaimer: I’m no economist (though I did major in Finance & Banking for my my Bachelors Degree) — I’m just a guy who reads the Wall Street Journal and San Francisco Chronicle, watches 60 Minutes and tunes into Bloomberg and Charlie Rose once in awhile. My observations are superficial at best.

Ok, in no particular order, here they are the 7 items that most worry me about an economic collapse (both in the U.S. and beyond).

Top 7 Variables At Play That Might Trigger A Coming Economic Armageddon

1) Inflation Is Percolating

Inflation was running above 2% (year to year) in March 2011, outpacing the increase in hourly wages (Wall Street Journal, April 2-3, 2011).

Wholesale food prices surged 3.9% month to month (biggest spike since 1974) (source: Wall Street Journal, March 17, 2011)

Oil prices could increase substantially due to Arab unrest.

The Japan Disasters Might Trigger More Inflation

The Japan Earthquake/Tsunami/Nuclear Plant Meltdown has the following effect on global inflation:

- Energy — Japan is currently short of about 20 to 40% of the energy that it needs to run the country, according to press estimates. To replace lost capacity, Japan will have to purchase more oil and gas on international markets.

- Food — Japan will also have to turn overseas for purchases of food as farm-land/ocean resources are potentially contaminated.

- Raw Materials — Japan needs to rebuild its country (ballpark cost is $200 billion) and that’s going to require steel, concrete and wood, items it will need to purchase on the international market.

The price of steel, by the way, is up 25% in the first quarter of 2011 alone!

You might say: “How do Japan’s woes affect prices in the U.S.?”

Cash-back rebates for Japanese cars might disappear for awhile due to the tsunami

Well, how about auto prices? Japan makes the car I drive and many of your cars too.

Japanese auto makers have recently started dropping the discounts and special incentive offers we’ve all gotten used to — that could add up to $2,000 to the price of your next car!

Japan also buys a lot of the U.S.’s treasury bonds — well, with less exports from Japan these days, the Japanese government is less likely to buy U.S. bonds; that might cause the U.S. to have to increase interest rates to attract other customers.

Higher interest rates often equates to — you guessed it — more inflation.

Inflation could play a key piece in a U.S. & global economic collapse.

2) Housing & Unemployment Still At Worst Levels in Decades

Remember the housing crisis we just came out of? I don’t think we’re out of the woods yet.

The S&P/Case-Shiller index of property values in 20 cities fell 3.1% from January 2010, the biggest year-over-year decrease since December 2009.

Housing Starts tumbled 22.5% in February (the sharpest decline in 27 years) (source: Wall Street Journal, March 17, 2011).

Foreclosure and vacancy rates are also at their worst levels in more than 50 years as seen by this BarclaysWealthBlog graph:

Bank of America Corp. chief executive Brian T. Moynihan said:

“The housing slump is the biggest challenge limiting the U.S. economic recovery.”

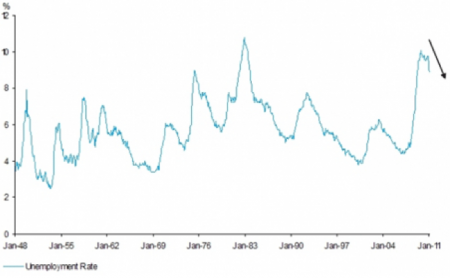

And keep in mind that unemployment, while it has improved slightly in recent months (see downward arrow in graph below), is still the worst its been in 25 years.

Sorry for the sucky graph — it’s the best one I could find showing data back to 1948.

If housing and unemployment — two of our economic pillars — continues to stall, we might fall into to a double-dip recession.

3) U.S. Municipalities Are In Big Trouble

A lot of talk these days is centered around the federal deficit (which I agree is a major problem); but let’s not take our eyes off the issue of our municipalities — American cities and states have debts totaling $2 trillion.

Analyst Meredith Whitney (she correctly predicted the global credit crunch) told 60 Minutes in December that:

More than 100 American cities could go bust in 2011 , she said, calling it “the singled biggest threat to the U.S. economy.”

This leads to real-life predicaments – -60 Minutes reported a few impacts of Municipal Debt issues

- Detroit is cutting police, lighting, road repairs and cleaning services affecting 20% of its population

- The University of Illinois is owed $400M from the State of Illinois

- California raised state university tuition fees by 32%

Jefferson County in Alabama (home to 650,000 including Alabama’s largest city (Birmingham) has debt of $3.2 billion and no easy way out.

If it filed for bankruptcy, Jefferson County would be the largest municipal bankruptcy ever (Orange County in Calif. had set the record in 1994 with $2 billion in debt) (Wall Street Journal, March 30, 2011).

And because local U.S. governments have such poor credit reports, they’re not able to raise as much money selling bonds:

They sold $46.4 billion in debt through March 30, according to Thomson Reuters, the lowest since 2000, when $39.1 billion was issued.

Clearly the U.S. municipal economies are in crisis.

4) U.S. Child Poverty At Worst Levels Since The Great Depression

Twenty-five percent of U.S. kids will soon live in poverty (the worst levels since the Great Depression), according to the 60 Minutes episode on March 6, 2011.

That’s sixteen million of our children at the poverty level!

Poverty in children is reported to lead to:

- Lower academic achievement (often 10 times the drop-out rate compared to higher income families)

- Worse health — Higher levels of asthma and anemia

- Homelessness

Continued child poverty could contribute to conomic collapse down the road as these children grow to adults and require even greater support while generating lower-than-average productivity.

In short, our team coming off the bench is going to have to do so with a severe economic handicap.

5) The U.S. Is Involved in At Least 3 Wars

- Iraq

- Afghanistan

- Libya

I’m no war historian, but 3 wars seems like a lot!

- Wars are costly from a financial perspective (they cost money).

- They add volatility to oil/energy prices (see “If Arabs were to embargo the U.S. below).

- They are a major distraction for U.S. leadership.

I wonder how much of Obama’s day is distracted by 3 different wars.

And as a result of these three wars, we have less military resources to throw at a true threat to our national security!

And these wars are still doing physical damage. Consider this:

U.S. soldiers suffered lost limbs in 2010 at a rate of more than double that of 2009 (171 soldiers had amputations in 2010 (as measured by the # brought to the main Medical Center), according to The LA Times on April 7, 2011.

6) There Is Massive Unrest In The Arab/Islamic World

This of course relates to the “3 Wars” item above but it goes even deeper than Iraq, Afghanistan and Libya.

A lot of the unrest globally is concentrated in Arab/Islamic areas such as:

- Yemen — Military revolting as of March 23, 2011

- Somalia — “Somalian governments all up for grabs,” says the Wall Street Journal, March 5-6, 2011.

- Syria — 37 people were killed in one day last Friday as Syrians pressure their government for reform.

These Arab/Islamic countries are also in disrepair.

- Morocco

- Algeria

- Egypt

- Tunisia

- Bahrain

Why should we care? One reason is that we’re highly dependent on Arab countries for oil as one of our main energy sources.

If Arabs were to embargo the U.S. (increasingly possible with Arab unrest), then we could see U.S. oil prices skyrocket!

This of course relates to item #1 above (inflation!).

Let’s also not forget that sovereign governments own an increasing amount of U.S. assets — they’ve really got us over a barrel (pardon the pun!).

The combination of our dependency on Arab/Islamic entities along with instability in their governments can lead to a number of economic problems.

7) The Mexico War On Drugs

Thirty-five thousand casualties in Mexico in the past year — mostly over drugs.

Mexico is close to a fourth war for the U.S. as it’s spilling over into some of our state’s back yards.

Dozens of Americans have been among those killed or kidnapped.

The U.S. Department of Homeland Security has said it is considering using the National Guard to counter the threat of drug violence in Mexico (something the Governors of Texas and Arizona have asked for help on).

This is a major distraction for Texas and Arizona leadership as well as the U.S. federal government.

And what’s more, many Americans have cultural and family ties south of the border – what happens in Mexico matters to the U.S.

This is a war that hits very close to home.

Honorable Mention: Retirement & Social Security Funds

There’s another item that’s further out in terms of timing, but well worth mentioning.

The following funds are due to run out of money, according to a March 22nd Wall Street Journal piece:

- Social Security Retirement — Funded through about 2040.

- Medicare — Can survive through about 2029.

- Social Security Disability Insurance (SSDI) — Can survive through 2015 to 2018.

Ok, let’s wrap up this financial armageddon piece.

I’m not all doom and gloom, people. I believe the U.S. is an amazing country and we are so industrious that we can power through any challenge we face.

But, if you like to be practical like me, look out for these and other Lollapalooza Effects.

Talk the issues up with your friends and loved ones.

Be smart about your financial moves.

And think about how you and your family are prepared for a potential economic crisis.

Tweet 3 Comments