57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

How To Process Credit Cards In-Person With No Merchant Account (It’s Called “Square”)

Tweet 1 CommentI believe the new payment application SquareUp (some call it just “Square”), which allows anyone to accept credit cards in person, is a game-changer in business.

I just bought a book using it from author Dom Songalla (pictured below) at a conference we both attended — it was simple yet powerful.

Author Dom Sogalla Shows Rob Kelly the SquareUp-Enabled iPhone

Dom simply popped his credit reader reader into the phone jack of his iPhone; and then swiped my credit card for $20.

A Square-Up Enabled iPhone

Here’s the receipt I received via email (note that it shows me the location of my purpose):

The whole thing really took just three steps:

- The author swiped my credit card on his iPhone

- I signed my signature with my finger on his iPhone screen

- He typed in my email and emailed me my receipt

And the beauty is that Square does not require you (the seller) to have a merchant account to accept credit cards — and there appears to be just one fee (2.9% of the transaction amount).

Others, including PayPal’s new Bump iPhone App, are also getting in the market of exchanging money between phones.

I like Square chances as much as anyone’s as it has smart folks like its co-founder Jack Dorsey (creator of Twitter) and Board member Gideon Yu (previous executive at Facebook, YouTube, Yahoo) behind it.

Click here for tweets from some Square advisors.

And since SquareUp is still in beta, you’ll have to go to the bottom of Square’s home page and give your email address to get in line to receive the card reader.

1 comment so far | Continue Reading »

Monday, April 27th, 2009

How I Boosted My FICO Score By 162 Points…To 778

Tweet 156 CommentsI used to have poor credit.

And if you’re like me, you’ve had to fund some or all of your business on credit. When I ran Mojam.com, I had to use cash withdrawls off of five credit cards just to meet payroll for a month or two!

Unfortunately, I was a dumb kid back then and didn’t pay back the loans fast enough (causing poor credit!).

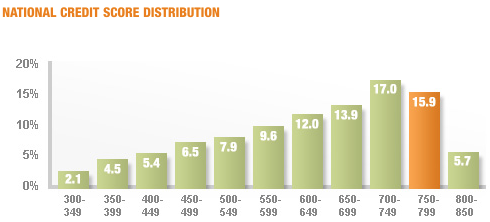

Here's where U.S. folks fall on their FICO score (source: CreditKarma)

So, below are some learnings from restoring my credit.

First off, this article focuses on how to maximize your opportunity to get personally-guaranteed credit…so it’s useful if you A) Run a small business where you have to personally gurantee your credit cards or B) Want to improve your credit outside of business (e.g. for mortgage or automobile loans).

Ok, first off, how do you measure your credit? — Currently, one matters more than all others: Your FICO score. FICO stands for Fair Isaac Corporation, a credit-scoring business that works with the three major credit bureaus (Equifax, Experian and Transunion) monitoring people’s credit.

FICO scores range between 300 and 850 (the higher being better) with a score of:

- 760 or better being Excellent (you’ll get offered the lowest loan rates with flexibility)

- 700 to 759 being Very Good (you’ll be offered above-average terms)

- 680 to 699 being Good (average terms)

- 620 to 679 being OK (you’ll be offered below-average terms)

- Below 620 — If you’re below 620 it is very uncertain what kind of loan you’d be offered, especially these days

FICO doesn’t make you loans but they provide the report card — the FICO Score — for others who do.

So, you might ask: How do I fix my credit?

Well, it’s based on a secret algorithm that changes all the time (sort of like Coke’s recipe or Google’s algorithm).

This article is sort of like reverse-engineering FICO.

I asked Scott Jones, a credit repair expert I worked with at CreditLine, to talk about the key ingredients of FICO’s secret recipe and how important each ingredient is (the % in parentheses). Here’s what he said:

Your Payment History (35% of score)

Basically, paying on time helps lift your score, while paying late, liens and bankruptcy will lower it.

The Amount You Owe (30%)

Keep your balance low to zero. Lenders don’t like to see you using up all your credit on your credit cards (i.e. letting the balance get high) so if you can keep it low (or, better yet, pay it down to zero), you’ll get some points for that.

The Length of Your Credit History (15%)

The longer you have a credit card the more points you get on your FICO score. Even if you use a credit card just sparingly (like me with my Mervyn’s Card), you get some good FICO points for just having it for a long time.

New Credit Inquiries (10%)

This one is interesting: When you apply for a loan (including getting a credit card), the company providing you with credit (i.e. Visa or Mastercard or AMEX or a department store or mortgage company or Auto Dealership) makes what is called a “New Credit Inquiry” with the credit agencies to see what your credit looks like. Each new inquiry can LOWER your FICO score (my guess is by 10 to 30 points) for a short amount of time (about three months); so, be careful not to take out a few credit cards at one time.

Get the Right Types of Credit (10%)

Different credit is measured differently. Below is one credit expert’s prioritization of which types of credit in order of importance (first being most important).

- Home loans

- Car loans

- Major credit cards (Visa, Mastercard, AMEX)

- Department store credit cards

- Student loans

Here are some other tips & final notes:

- You Start Off Pretty Good — When you first get a FICO score (18 years old appears to be the minimum age to get a credit card) you start off from a position of strength! Since 30% of the FICO score depends on money you owe, my guess is that you start off with a FICO score somewhere in the 600 range.

- Be Maniacal about paying all of your bills on time — I don’t mean to scare you, but I once paid a Macy’s credit card bill 60 days late and it cost me about 50 points on my FICO score!

- If You Carry a Balance on Your Credit Card — If you must hold a balance on your credit card (I recommend that you don’t) then try to keep it to half or less of your available credit.

- Don’t Do Debt Consolidation — Credit consolidation (putting all your debts onto one credit card) is usually a bad idea (unless the other card is lower interest and you can pay THAT balance off within a year).

- Own just a few credit cards (I think 2 to 5 cards seems right) and use them once in awhile and pay them off immediately when you do.

- Don’t Cancel Credit Cards — I don’t believe that canceling credit cards can help your FICO score and it can definitely hurt it (because of the Length of Credit History piece)

- If you ever get billed for something and you believe that you do not owe the money, you should IMMEDIATELY contact the biller and straighten it out (and make sure it’s corrected by Experian, Transunion and Equifax).

If you’re like me and you made a bunch of mistakes already, you can repair your credit but it takes time. A Couple of Options:

Do it Yourself — You can get free online credit reports from all three agencies at CreditReport.com and you should! Go to Check out the details of each (they will list each one of your credit cards or loans) and if you can find an incorrect piece of info or an inconsistency among the three agencies (one of them reports that you were late on paying your AMEX card and the other two do not), then write a “letter of correction/deletion” to try to fix your credit report.

That doesn’t harm you and typically can turn into them correcting/removing the item in a way that positively impacts your credit

Use a Credit Repair Service — I used a service called CreditLine and I ended up increasing my score from 616 to 778 within two and one-half years; an average of about 15 points every three months.

I used their premium service and it was worth every penny. It helped me get bettter terms on my car loan and gives me piece of mind about getting a loan for a anything else in the future. They also provided me with phone-based credit counseling.

Either way, make sure you’re in tune with your FICO score, apply what tips you can and good luck with your credit restoration.

Question for you: Do you know how credit works outside the U.S.? If you do, please comment below with any tips you have — thanks!