57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

Wanna Buy Facebook Stock Pre-IPO? — Tips Inside

Tweet 5 CommentsI sat in on a conference call hosted by Sharespost, a marketplace for privately-held stock, today to learn more about buying stock in private companies. Nearly 100 Sharespost members were on the phone.

Facebook Founder Mark Zuckerberg at South By Southwest 2008

I thought I’d share the basics of how buying privately-held stock works using Facebook (the topic of today’s call) as the example.

The below information is based on knowledge as well as things I learned from today’s call (hosted by Tim Sullivan of Sharespost).

How do you buy Facebook stock when it’s still privately-held?

Some Facebook insiders, such as former employees, have begun to sell their privately-held shares through new private exchanges such as Sharespost, SecondMarket, Cogent Partners and Campbell Luytens.

Who is selling the Facebook stock in this case?

A former Facebook employee is selling 50,000 shares of their Facebook stock, according to Tim Sullivan of Sharespost.

Do you buy Facebook stock directly from the employee?

No. You typically buy membership units in a new fund that buys the Facebook stock for a group of investors and you own your pro-rata % of the fund.

For example, Sharespost in this case is offering membership units in a newly-formed Delaware-based LLC that will hold up to 50,000 of Facebook’s privately-held shares at $20 per share.

Can anyone buy these Membership Units?

No. You have to be an accredited investor and you have to be chosen by the firm (e.g. Sharespost in this case) offering the Membership Units.

There may also be a minimum investment you have to make to be buy Membership Units (e.g. Sharespost is asking that you commit at least $100,000).

Who sets the price of the privately-held Facebook stock?

In this case, Sharespost is setting the price. They have closed an exclusive deal with the former Facebook employee to buy their 50,000 shares at $20 each (a total of $1 million).

What is Facebook’s valuation?

Around $45 billion based on these Sharespost Membership Units.

Can Facebook veto the purchasing of their stock by outsiders.

Yes. Facebook can exercise their right of first refusal (also known as a “rofer” or “rofering”) on stock that their insiders are trying to sell within 30 days of the attempted sale of the Facebook stock.

How often does Facebook “rofer” their stock?

Facebook rofers their purchase of privately held Facebook stock about half the time it’s available, according to Sharespost’s Tim Sullivan. He added that he heard that Facebook rofered stock at $18 per share recently.

When could a buyer of these Facebook Membership units sell their stock?

Owners of the Facebook Membership Units could sell their stocks through Sharespost private marketplace (though it’s not guaranteed that there will be a buyer) or at the point of a Facebook IPO (Initial Public Offering).

note: there will be lock-up restrictions on the exact timing of your sale of the Membership Units/Facebook stock.

What commission does the private marketplace (e.g. Sharespost) take in the transaction.

Sharespost is charging a one0time services fee of 5% and a distribution fee of 3% (of the total size of the round of funds they raise through the private placement).

Is SharesPost affiliated with Facebook.

No.

Does Facebook have audited financials that the public (or prospective buyers of the Membership Units) can see?

No.

What’s Facebook’s estimated revenues or profits.

It’s not publicly disclosed, but there are reports of Facebook’s revenues for 2010 being projected at anywhere from $1.5 billion to $2.4 billion, according to Tim Sullivan.

Is Facebook profitable?

Tim says that there are reports of Facebook being more profitable (on a margin basis) than Google, one of the most profitable publicly-traded Internet companies.

Has Facebook’s stock recently split?

Yes, there was a 5 for 1 split of Facebook shares October 1, 2010, according to Tim Sullivan.

Will Sharespost offer additional Facebook shares for purchase in the future.

Yes. Sharespost expects to offer additional Facebook shares in the future. Other private marketplaces likely will too.

5 comments so far (is that a lot?) | Continue Reading »

Thursday, November 18th, 2010

Etsy: The “eBay of Handmade Goods” Worth $258 Million?

Tweet 1 CommentI was on an interesting conference call by Arcstone Equity Research & SharesPost in which they walked through the Web business Etsy.

New York-based Etsy is clearly a company on the move.

What Is Etsy?

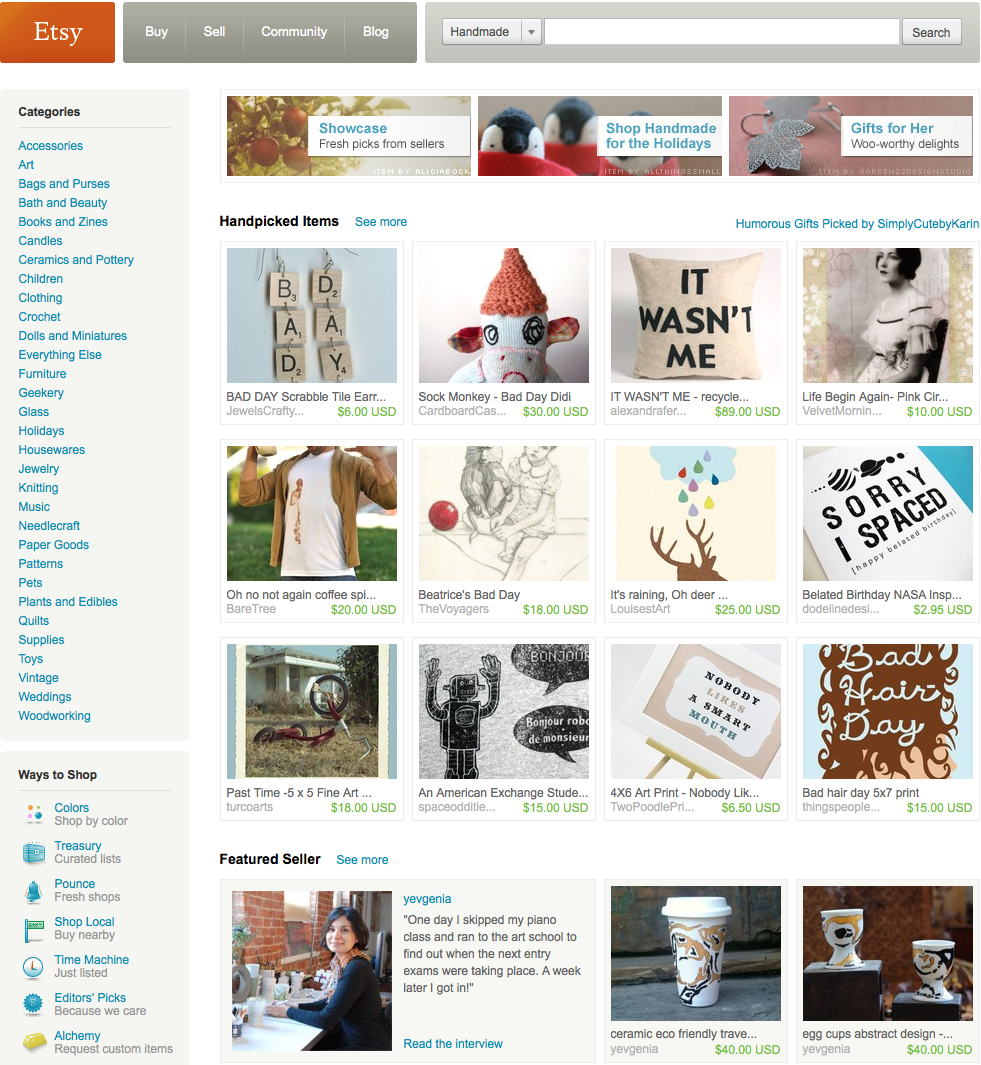

The gist of Etsy’s business is that they’re a marketplace of hand-made goods (sort of eBay but primarily hand-made)…here’s a screen shot showing you some of the types of things they sell.

Disclaimers: The #s I mention are not from Etsy (they are all estimates based on Arcstone Equity Research & SharesPost)

Special thanks to Arcstone & SharesPost for all the graphs below:

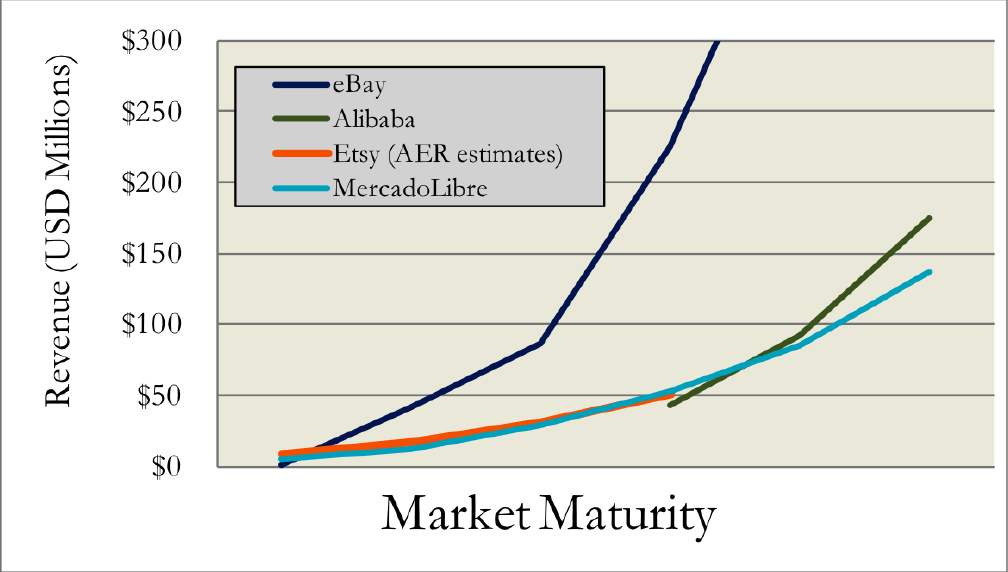

Etsy’s Growing As Fast As Alibaba (But Not As Fast As eBay)

Etsy Business Model

- Taking 3.5% of every sale and $.20 per item for a listing fee

- Selling advertising (where they make about half their money)

![Etsty's Gross Merchandise Sales By Month 2008 to 2010 from Arcstone]](https://robdkelly.com/wp-content/uploads/2010/11/Screen-shot-2010-11-18-at-10.19.13-AM1-1024x495.png)

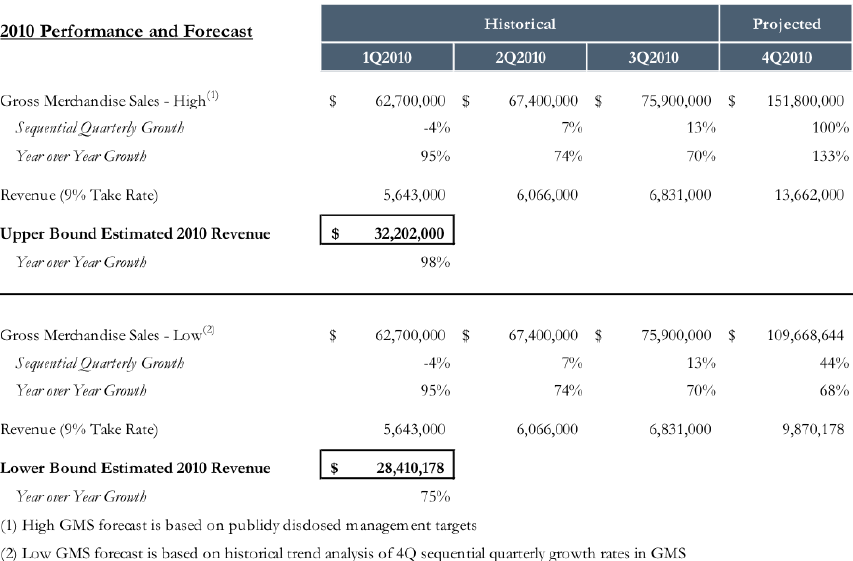

Etsy Revenues, Profits, etc.

- Estimated Valuation: $258 Million

- Estimated Revenue

- $16M in 2009 ($180 million in gross transaction values)

- $30M in 2010 (on $335 million in gross transaction values)

- Around $54M is projected in 2011

- Profitable

- 120 employees

Etsy’s Team

Top Officers

- Robert Kalin

- Chad Dickson (Yahoo)

- Alan Freed (Google)

Outside Board Members

- Jim Breyer

- Fred Wilson

- Caterina Fake

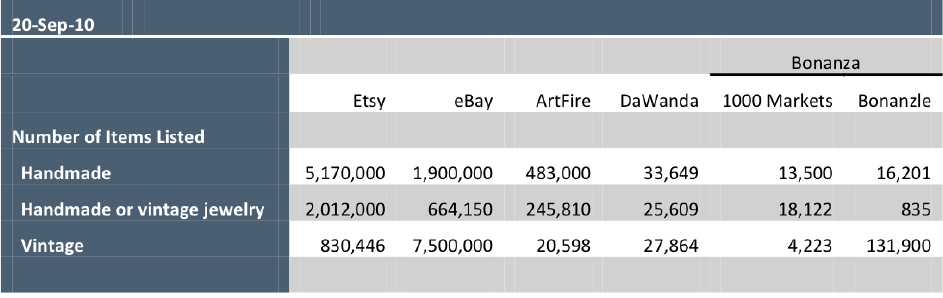

Etsy Competition

Some sites like Etsy are:

- eBay (both through its own service and through acquisition of World of Good)

- ArtFire

- DaWanda (in England, France & Germany)

- 1000 Markets

- Bonanzle

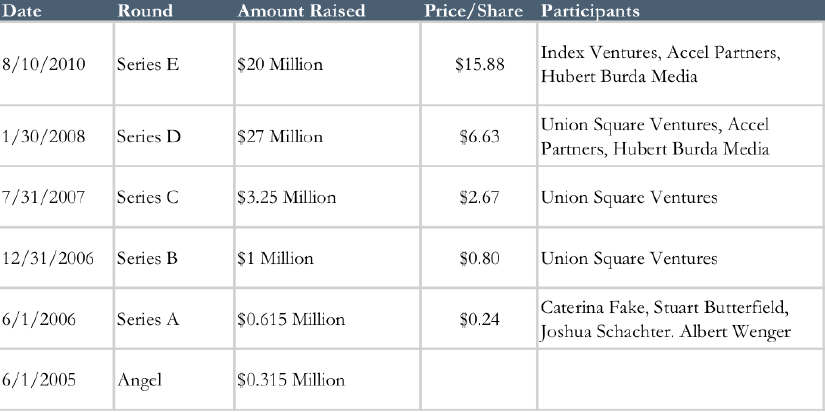

Etsy Financing To Date

Other Etsy Highlights

- 4.4 Million members

- Hired a new COO (Alan Freed) from Google last year who has an emphasis on International

- 2 million of 5 million products are Jewelry

Etsy’s Valuation

- $258 Million (10X Annual Revenues (discounted 15% for lack of marketability))

My Take On Etsy

Fascinating Internet business on the move…a real niche dominator.

My best guess as to what will happen with Etsy: They will go public or be acquired by Amazon (Amazon loves to take out companies when they’re in the $100 million to $500 million per year revenue and if they own a niche).