57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

Why Did Ballmer & Others Dump A Record $4.5 Billion In Stock Last Week?

Tweet CommentWhen a super smart guy like Steve Ballmer (he is that smart…I’ve met him a few times) dumps $1.34 billion worth of stock — his first stock sale in 7 years! — I like to dig in a bit

Ballmer was part of a slew of insider stock sales last week, which saw a 2-year high in stock prices.

The volume of insiders selling their stock versus those buying their stock is a good leading indicator of where the stock market might head.

Afterall, if insiders (defined as stock sales by directors, executives or employees of a public company) are selling their own stock, it may be because they believe the stock price has hit a peak (alternatively, they may just need some quick cash).

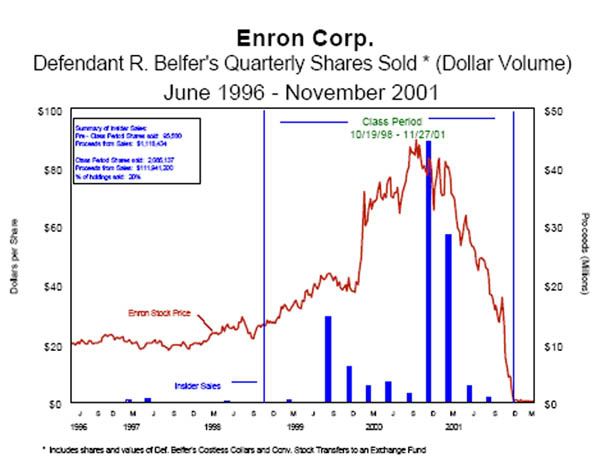

In more extreme examples, insiders may sell their stock because the company is in real trouble; some speculate that’s what was happening in the below chart (from a decade ago) showing an Enron insider selling a bunch of stock (the blue columns) when the stock price was peaking (the red line).

The news this week doesn’t necessarily involve fraudulent activity but clearly some insiders see the market peaking.

Back to Ballmer…

Ballmer was among executives at 125 companies in the S&P 500 who sold a total of $4.5 billion in stock between Nov. 3rd and 9th… at a ratio of 12 insider sellers for ever 1 insider buyer.

That’s the highest ratio of sellers to buyers on record (InsiderScore has only been tracking the data since January 2004).

The best other explanation for high insider sales is that some insiders may be worried that their capital-gains tax rate for assets owned at least a year will increase from 15 percent 20 percent in January (unless President Barack Obama and Congress extend the 15% rate.).

My take is that the reason for the record insider sales is a combination of insiders thinking that the market may be peaking AND some folks worried that cap gains taxes are going up.