57 Meditations on Kicking @$$ in Business and Life"4.8/5 stars" on Amazon

5 Tips On How I’ve Doubled My Income Every 5 Years

I can’t help but feel cheesy writing the above headline — it feels like something a shuckster — trying to sell you something — would write.

But I’m not selling you anything…other than some free advice!

I know a lot of you want to increase your income over time (I do) and I recently had an “uh-huh” moment about my own personal income path.

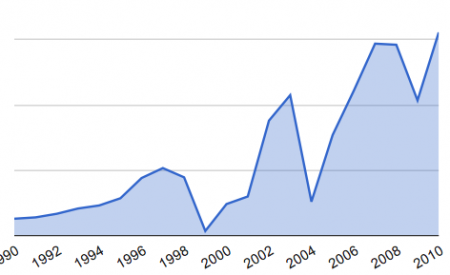

The below graph is my income plotted over the last 20 years (you’ll notice that I don’t volunteer my actual income in the graph — that’s because it’s none of your business!).

I took my personal income and plotted it by year since I began my career; this helped me understand what causes my income to grow

Tips On Increasing Your Income

1) Plot Your Historical Income Onto A Spreadsheet

The first tip I have is that you need to plot out your past income onto a spreadsheet and chart it out (like the graph above).

All I did was take out my old income tax returns and open up a Google Doc spreadsheet and then I put:

- The first year I produced income (1989) in cell A1 and the amount of income for 1989 in cell A2.

- Then I put the second year (1990) in cell B1 and that year’s income in cell B2, and so on (until you have all your years inputted)

- Then I selected the entire range of 20 years of income and clicked the chart/graph button on Google Docs

2) Examine The Trend Of Your Income

Next up, you want to look at what the trend is of your own income.

Why did it go up in certain years? And why did it go down?

Unless you’re on a fixed-income, chances are that your income had its ups and downs. So what is the trend of your income?

For me, the trend was that I had ups and downs, but every 5 years my income roughly doubled.

By the way, how powerful is doubling your income every 5 years?

Well, let’s say you’re a kid out of college right now and you make $50,000 in your first year out of school.

If you doubled your income every 5 years then you would be making $500,000 before your 40 and $1.6 million a year in income by the time you’re 46.

I hope my nephew and niece are reading this!

3) I Increased My Salary By Job-Hopping My First 5 Years

I was an analyst/journalist for my first 5 years or so and I just plain worked my tail off and moved from jobs twice.

A combination of working hard and switching jobs (moving to larger roles) resulted in my income doubling in my first 5 years.

4) I Moved To The “Dark Side”: Commissions & Bonuses

The next income-changer I experienced was moving to a revenue generating role: business development.

My “biz dev” role tied my actions more closely to sales: performance-based pay.

My “biz dev” role allowed me two new performance-based sources of revenue:

- Commissions — The more revenue I produced (through partnerships) the more money I made

- Bonuses — If I helped my employer reach certain goals, I also got a bonus

If you are achievement-oriented, commissions and bonuses can be real fun.

5) I Took Ownership Equity

My personal income graph showed me that when I took equity in a company, my income increased over time.

There are a few ways that I earned equity in businesses:

- I started my own business (which I later sold)

- I advised other people’s businesses (in return for stock)

- I took a senior position at a company (in return for equity)

Think Long-Term: “One Step Back, Two Steps Forward”

Finally, you’ll notice that my income had some serious dips during this time.

These dips in income represented chances I took or actual setbacks, but always resulted in a subsequent opportunity for income growth.

I took a big dip in 1998 to 1999 as I launched my startup Mojam and paid myself a super-low salary (but I was rewarded for that dip when we sold Mojam years later because I owned a lot of its equity).

I also took a dip in income in 2004 as I was laid off from Topica and searched for my next opportunity; but my income surged back as I found a new job with more equity.

You often have to take risks and experience setbacks to get further ahead

I hope this helps you or your loved ones increase their income!

Tweet 4 Comments